2014 Annual Report to Shareholders

Perth, Sep 30, 2014 AEST (ABN Newswire) - Major milestones achieved during the development of Atrum Coal NL's ( ASX:ATU) (

ASX:ATU) ( ATRCF:OTCMKTS) 1.57 billion tonne Groundhog Anthracite Project over 2014 included the completion of a Pre-Feasibility Study (PFS), which demonstrated robust economics for a peak 5.4Mtpa run-of-mine underground operation at Groundhog. The PFS demonstrated that pre-production costs at Groundhog would be approximately A$10 million in 2014/15, and ramp-up costs in 2015/16 would total US$70.6M under contract mining and build-own-operate-transfer (BOOT) arrangements. Using independent price forecasts and a discount rate of 8%, the project has a pre-tax Net Present Value (NPV) of A$2.1 billion (post-tax NPV of A$1.3 billion) and a pre-tax Internal Rate of Return (IRR) of 68% (post-tax IRR of 51%) based on power and road infrastructure CAPEX being funded by Atrum.

ATRCF:OTCMKTS) 1.57 billion tonne Groundhog Anthracite Project over 2014 included the completion of a Pre-Feasibility Study (PFS), which demonstrated robust economics for a peak 5.4Mtpa run-of-mine underground operation at Groundhog. The PFS demonstrated that pre-production costs at Groundhog would be approximately A$10 million in 2014/15, and ramp-up costs in 2015/16 would total US$70.6M under contract mining and build-own-operate-transfer (BOOT) arrangements. Using independent price forecasts and a discount rate of 8%, the project has a pre-tax Net Present Value (NPV) of A$2.1 billion (post-tax NPV of A$1.3 billion) and a pre-tax Internal Rate of Return (IRR) of 68% (post-tax IRR of 51%) based on power and road infrastructure CAPEX being funded by Atrum.

The infrastructure required will be optimised further through off-balance sheet funding provided by Atrum Infrastructure Pty Ltd further improving the NPV and IRR. The PFS for Groundhog focussed on the north-west zone and on just two seams from more than 20, representing less than 5% of the total project area, so potential for future growth remains.

An optimised PFS is due to be released taking into account attractive equipment financing terms currently being offered in the market which will result in reduced CAPEX and OPEX. The recent drilling and trenching program and geological correlation has highlighted the potential for Groundhog to support multiple mines and the Company is now undertaking concept studies for mines in other locations across the property.

Atrum's management has laid the foundation for our entry into the market as we continue to build relationships with key steel and specialty product manufacturers. Groundhog has the potential to deliver significant amounts of high-grade anthracite to steelmakers operating in a safe mining jurisdiction in a way that is currently not available, and many potential customers are excited about what the project offers.

We successfully completed maiden ship loading trials at Stewart Bulk Terminal to test storage, coal handling and loading facilities and this demonstrated that the existing equipment is capable of loading at least 1.5Mtpa of anthracite. The Company also has an agreement for a further 5Mtpa capacity at Stewart World Port (SWP), which is currently under construction. We plan to deliver first anthracite on ship through trial mining during 2015, and we are currently preparing market samples for customers.

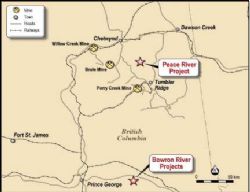

We expanded our tenure in British Columbia during the year, initially with the granting of a further four coal licences, and then with the addition of 20 granted coal licences and one coal license application purchased from Anglo Pacific PLC. With the acquisition of the Anglo Pacific PLC licences, Atrum has succeeded in consolidating all the known anthracite-bearing tenure in the Groundhog and Panorama coalfields. The Company now holds approximately 800sqkm of contiguous licences in the World's largest known high grade and ultra-high grade anthracite resource, only 150km direct distance to a deep sea port that is open all year round.

In May, we announced that Kuro would develop the Panorama Anthracite Project under joint venture. However, after reviewing geological information for the Panorama region and in light of Atrum's strategy to be the world's largest producer and exporter of high-grade anthracite, we have decided to retain Panorama. The project has the potential to contribute significantly to our overall multi-mine plans and Atrum will begin exploration at Panorama pursuant to the recently granted Notice of Works.

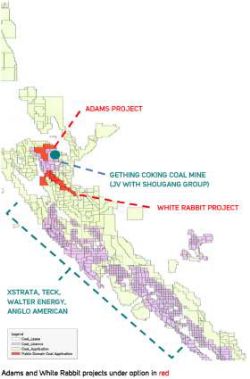

As previously announced, the non-core assets currently held in Atrum (Naskeena, Peace River and Bowron River) are being moved into Kuro Coal Limited, with an IPO of Kuro planned prior to the end of 2014. Subsequent to the end of the financial year, Kuro added to its portfolio of exploration assets with the addition of an earn-in joint venture on a JORC compliant coking coal asset, Elan. Atrum shareholders will be eligible for one free Kuro share for every four Atrum shares held at the record date.

As we progress towards production, we made a number of significant Board and management appointments. Steven Boulton and Cameron Vorias became Non-Executive Directors of the Company, both with more than 30 years of experience in the industry. Steve is one of Australia's leading infrastructure executives and will assist the Board to deliver a low-cost infrastructure strategy initially at Groundhog as well as helping the Company develop infrastructure options for our multi-mine strategy. Cameron's experience in coal mining operations including new project development, resource management and risk management will also be invaluable to Atrum.

We established an Anthracite Marketing Advisory Committee (AMAC) and appointed leading coal marketing specialists George Edwards and Stephen Gye. Combined, they have more than 85 years' experience in global metallurgical coal and coke markets. AMAC will bring together industry experts to oversee our strategic off-take discussions and ensure the Board can maximise shareholder value.

Other strategic appointments include Peter Doyle as our VP Marketing and Business Development, Ben Smith as VP Operations and Rick Greene as Project Manager (Mining Operations) and Theo Renard (VP Commercial). Each of these appointments will play an important role in Atrum's future.

(from James Chisolm's address to shareholders in the annual report)

To view the annual report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-ATU-693095.pdf

About Atrum Coal Limited

Atrum Coal Limited (ASX:ATU) is a metallurgical coal developer. The Company flagship asset is the 100%-owned Elan Hard Coking Coal Project in southern Alberta, Canada. Elan hosts large-scale, shallow, thick, hard coking coal (HCC) deposits with a current JORC Resource Estimate of 298 Mt (70 Mt Indicated and 228 Mt Inferred). Comprehensive quality testing of Elan South coal on samples from the 2018 exploration program, combined with review of substantial historical testwork data for the broader Elan Project, has confirmed Tier 1 HCC quality.

Atrum Coal Limited (ASX:ATU) is a metallurgical coal developer. The Company flagship asset is the 100%-owned Elan Hard Coking Coal Project in southern Alberta, Canada. Elan hosts large-scale, shallow, thick, hard coking coal (HCC) deposits with a current JORC Resource Estimate of 298 Mt (70 Mt Indicated and 228 Mt Inferred). Comprehensive quality testing of Elan South coal on samples from the 2018 exploration program, combined with review of substantial historical testwork data for the broader Elan Project, has confirmed Tier 1 HCC quality.

The initial focus for development is the Elan South area, which is located approximately 13 km from an existing rail line with significant excess capacity, providing direct rail access to export terminals in Vancouver and Prince Rupert. Elan South shares its southern boundary with Riversdale Resources Grassy Mountain Project, which is in the final permitting stage for a 4.5 Mtpa open-cut HCC operation. Around 30km to the west, Teck Resources operates five mines (the Elk Valley complex) producing approximately 25 Mtpa of premium HCC for the seaborne market.

| ||

|