Quarterly Activities Report

Quarterly Activities Report

Sydney, April 30, 2014 AEST (ABN Newswire) - During the quarter Julian Malnic was appointed a director of Sovereign Gold Company Limited ( ASX:SOC) and Chief Executive Officer of Mount Adrah Gold Limited (Mount Adrah) (formerly called Gossan Hill Gold Limited).

ASX:SOC) and Chief Executive Officer of Mount Adrah Gold Limited (Mount Adrah) (formerly called Gossan Hill Gold Limited).

Spin out Mount Adrah through ASX IPO (ASX 31 March 2014)

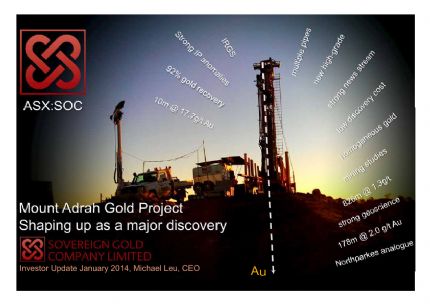

Sovereign Gold announced the spin out of Mount Adrah to be listed on the ASX in the second quarter 2014. Sovereign Gold's existing shareholders are eligible to apply for shares in a priority offer. Funds raised by the listing will be used to locate a major gold deposit with the principal focus on the Mount Adrah gold project where the JORC compliant resource is 770,000 oz. of gold (440,000 oz. Indicated, 330,000 oz. Inferred) within a total Mineral Resource estimate of 20.5 Mt at 1.1 g/t gold at various cut-off grades.

Mount Adrah prospectus lodged (ASX 4 April 2014)

Sovereign Gold announced the lodgement of a prospectus with ASIC for the initial public offering of Mount Adrah to raise between $2 million and up to $3 million. Sovereign Gold shareholders as at 10 April 2014 can participate in a priority offer with guaranteed allocation. Listing on the Australian Securities Exchange anticipated for June 2014.

A Supplementary Prospectus was lodged by Mount Adrah on 15 April 2014.

Corporate Restructure (ASX 9 April 2014)

Sovereign Gold and Precious Metal Resources Limited (PMR) have reached agreement on a proposed corporate restructuring to rationalise and simplify the structure and assets of each company (Corporate Restructure).

Sovereign Gold and PMR currently hold exploration tenements in the New England district of New South Wales targeting gold, silver and base metals.

Both Sovereign Gold and PMR have separately entered into Joint venture agreements and memoranda of understanding with Jiangsu Geology and Engineering Co. Ltd. (SUGEC) of Nanjing, China, whereby SUGEC is to provide up to $21.5 million funding across the SUGEC Project Tenements.

------------------------------------------------------ Joint Venture MoU------------------------------------------------------Sovereign Gold $4.5 million $7 millionPMR $2 million $8 million $6.5 million $15 million------------------------------------------------------

The directors of both Sovereign Gold and PMR are of the view that the proposed Corporate Restructure will provide a simpler, more efficient structure that eliminates unnecessary corporate overhead in managing the SUGEC relationship, which is currently being borne by both companies.

Proposed Corporate Restructure

The following steps are proposed in order to rationalise the structure and facilitate effective management time and focus on the various exploration project areas held by Sovereign Gold and PMR:

1. Sovereign Gold to acquire EL4474, EL5339 and EL7679 (PMR SUGEC Tenements);

2. Sovereign to relinquish control of PMR;

3. PMR would conduct a selective reduction of capital, whereby 64,000,000 shares in PMR, held by Sovereign Gold, would be cancelled;

4. Sovereign Gold would then acquire the PMR SUGEC Tenements for consideration of 1 million Sovereign Gold Shares (in satisfaction of LR 10.7).

At the conclusion of the transactions, Sovereign Gold would reduce its holding in PMR from 67,570,938 shares (78.00%) to 3,570,938 shares (15.53%) allowing PMR to develop independently of Sovereign Gold.

The transactions are conditional to obtaining the approval of both Sovereign Gold and PMR shareholders and any other statutory or regulatory approvals or exemptions that may be necessary.

Full details, including independent assessment of the fairness and reasonableness of the transactions, will be provided in the respective Notices of Meeting.

To view full quarterly activities report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-SOC-795056.pdf

About Sovereign Gold Company Limited

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:SOC) and Chief Executive Officer of Mount Adrah Gold Limited (Mount Adrah) (formerly called Gossan Hill Gold Limited).

ASX:SOC) and Chief Executive Officer of Mount Adrah Gold Limited (Mount Adrah) (formerly called Gossan Hill Gold Limited). Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.