$4 Million Funding Secured from Bergen Global Opportunity Fund

$4 Million Funding Secured from Bergen Global Opportunity Fund

Sydney, Dec 16, 2013 AEST (ABN Newswire) - Sovereign Gold Company Limited (Sovereign Gold) ( ASX:SOC) has entered into a Convertible Securities Agreement (Agreement) with Bergen Global Opportunity Fund II, LLC (Bergen), a US-based institutional investor managed by Bergen Asset Management, LLC to provide funding of up to $4 million over the next two years.

ASX:SOC) has entered into a Convertible Securities Agreement (Agreement) with Bergen Global Opportunity Fund II, LLC (Bergen), a US-based institutional investor managed by Bergen Asset Management, LLC to provide funding of up to $4 million over the next two years.

- Available funding up to $4 million over the next 2 years

- Transaction secures additional funds for Sovereign Gold to continue exploration activities across various projects

- Funding provided by New York based fund, Bergen Global Opportunity Fund

The funds will be used to support Sovereign Gold's exploration activities and development across its various projects.

Sovereign Gold's Managing Director, Mr. Michael Leu said: "The Agreement provides Sovereign Gold with immediate access to funds through a flexible, convertible instrument with the ability to secure additional funding in stages. We are pleased to have secured this funding from New York based Bergen."

Bergen Asset Management, LLC's Managing Director, Mr. Eugene Tablis commented: "Sovereign Gold's announcements have referred to the company working on a rare gold system, both in size and in style of mineralization. We have followed Sovereign Gold's progress for a while, and are pleased to be able to support the company's development during this crucial phase."

Under the Agreement, Bergen will invest a minimum of $1 million, and up to $4 million in Sovereign Gold by purchasing up to four interest-free unsecured convertible securities (Convertible Securities).

The facility provides Sovereign Gold with certainty of access to funding over the next 24 months.

The first investment of $1 million will be made immediately by way of a Convertible Security with a face value of $1.1 million.

Each of the subsequent three Convertible Security tranches may be purchased, subject to certain conditions, at a purchase price of $500,000 and a face value of $550,000 each.

Sovereign Gold and Bergen may increase the purchase price and the face value of the subsequent Convertible Securities to up to $1,000,000 and $1,100,000 respectively, each.

The Agreement includes terms that grant Sovereign Gold the right to repurchase the Convertible Securities for cash within a certain period of time and limitations on Bergen's disposal of the shares received on conversion.

The additional key terms and conditions of the Agreement are summarised in the Annexure attached via link below.

About Bergen Asset Management

Bergen Asset Management is a New York-based asset management company that invests in high growth public and private companies around the world with a particular emphasis on the mature markets in Asia-Pacific. Bergen has made a number of investments in the Australian junior resources sector, and has successfully backed a number of ASX-listed companies.

To view the full release:

http://media.abnnewswire.net/media/en/docs/ASX-SOC-774082.pdf

About Sovereign Gold Company Limited

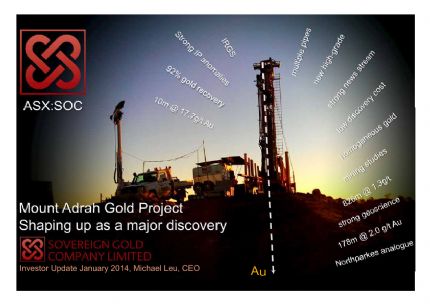

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:SOC) has entered into a Convertible Securities Agreement (Agreement) with Bergen Global Opportunity Fund II, LLC (Bergen), a US-based institutional investor managed by Bergen Asset Management, LLC to provide funding of up to $4 million over the next two years.

ASX:SOC) has entered into a Convertible Securities Agreement (Agreement) with Bergen Global Opportunity Fund II, LLC (Bergen), a US-based institutional investor managed by Bergen Asset Management, LLC to provide funding of up to $4 million over the next two years.  Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.