Mt Adrah Hobbs Pipe 1 Project Economics Review

Mt Adrah Hobbs Pipe 1 Project Economics Review

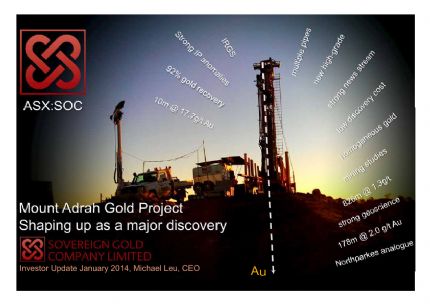

Sydney, Aug 7, 2013 AEST (ABN Newswire) - Sovereign Gold Company Limited's ( ASX:SOC) Mt Adrah Hobbs Pipe 1 Project Economics Review and scoping study is underway for the Hobbs Pipe 1 deposit, with guidance from a team of highly respected consultants and mine developers. Initially, this work is focussing on the metallurgical; caveability and sulphide concentrate transport costs and potential revenue generation for the project.

ASX:SOC) Mt Adrah Hobbs Pipe 1 Project Economics Review and scoping study is underway for the Hobbs Pipe 1 deposit, with guidance from a team of highly respected consultants and mine developers. Initially, this work is focussing on the metallurgical; caveability and sulphide concentrate transport costs and potential revenue generation for the project.

Metallurgy

Whilst the mineralisation is regarded as refractory, two separate metallurgical laboratories have confirmed high recoveries in flotation concentrates.

- 9-10% free gold (ALS Metallurgy Burnie 26 July 2013)

- 95% recovery of remainder in sulphide flotation concentrate (ALS Metallurgy Burnie 26 July 2013).

Confirms independent metallurgical testing in 1996 of 94% recovery of gold to flotation concentrate (Independent Metallurgical Report Mount Adrah Project, NSW, 1996. B. E. Enterprises)

- B.E. Enterprises also reported "Preliminary bacterial oxidation testwork resulted in a recovery of 91.9% gold after bacterial oxidation" from sulphide concentrate.

Preference is for Sale of Concentrate

- Significant reduction in Capex and regulatory hurdles

- Basic mill technology: crushing, milling, gravity, flotation

- Expedite approvals for mine and cash flow development

- Discussions underway with potential off take buyers in China

Milling Costs

- Intrusion-hosted Intrusion-Related Gold System Mineralisation typically has lower milling energy costs per tonne relative to porphyry Cu-Au mineralisation.

- A Bond Ball Mill Work Index (BBMWI) test is a standard test for determining the BBMWI of a sample of ore. The BBMWI is a measure of the resistance of the material to crushing and grinding.

It can be used to determine the grinding power required for a given throughput of material under ball mill grinding conditions.

- The BBMWI for Donlin Creek 'Intrusive' type of ores (similar/identical to Mount Adrah) range from 13.9-15.1 kWh/t. As a comparison, Cadia Hill, Ridgeway and Cadia East are 17.5, 18.7 and 20.3 kWh/t, respectively. Northparkes diorite-hosted ore is 15kWh/t.

Homogenous mineralisation with no 'nugget' effect supports low cost potential for:

- Resource drill-out

- Reliable grade control

- Constant uniform feed to plant

- Meeting production schedules

Mining Methods

- Highly regarded JKTech Pty Ltd have been engaged "to provide a high level study to evaluate the Mount Adrah orebody caveability and assess the potential for block or sublevel caving methods based on geological and geotechnical criteria".

Excellent Logistics for Potential Gold Mine Development

- Mt. Adrah is located approximately 400km south west of Sydney in Southern NSW

- Supportive community

- Close to power, water, major highways, labour, engineering and other key services (vs high cost, remote, fly-in/fly-out operations)

- 17km northwest Adelong township and gold mining centre

- Easily accessible - predominately Freehold grazing country

To view diagrams, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-SOC-748466.pdf

About Sovereign Gold Company Limited

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:SOC) Mt Adrah Hobbs Pipe 1 Project Economics Review and scoping study is underway for the Hobbs Pipe 1 deposit, with guidance from a team of highly respected consultants and mine developers. Initially, this work is focussing on the metallurgical; caveability and sulphide concentrate transport costs and potential revenue generation for the project.

ASX:SOC) Mt Adrah Hobbs Pipe 1 Project Economics Review and scoping study is underway for the Hobbs Pipe 1 deposit, with guidance from a team of highly respected consultants and mine developers. Initially, this work is focussing on the metallurgical; caveability and sulphide concentrate transport costs and potential revenue generation for the project.  Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.

Sovereign Gold Co Ltd (ASX:SOC) is an Australian-based specialist gold exploration company. Sovereign Gold has a portfolio of quality tenements located in Eastern Australia where there is known potential for the occurrence of Intrusion-Related Gold Systems (IRGS). Sovereign Gold has a highly prospective tenement package covering the Rocky River-Uralla Goldfield, 21km southwest of Armidale, NSW, Australia. Sovereign owns the recent Mt Adrah Hobbs IRGS discovery south-east of Wagga Wagga, NSW.