Scoping Study for Mayoko-Moussondji

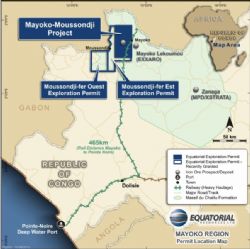

Perth, July 16, 2013 AEST (ABN Newswire) - Equatorial Resources Limited ( ASX:EQX) is pleased to announce that the completed Scoping Study for its 100% owned Mayoko-Moussondji Iron Project ("Mayoko-Moussondji" or "the Project") in the south-west of the Republic of Congo ("ROC") has delivered excellent results.

ASX:EQX) is pleased to announce that the completed Scoping Study for its 100% owned Mayoko-Moussondji Iron Project ("Mayoko-Moussondji" or "the Project") in the south-west of the Republic of Congo ("ROC") has delivered excellent results.

Equatorial's Managing Director and CEO, Mr John Welborn, said: "The Scoping Study has identified an immediate pathway to a 2 million tonne per annum hematite mining operation producing a premium product transported by the existing railway and port facilities. The study demonstrates that our Project has a number of advantages: the potential for a high quality product, low capital requirements, competitive operational costs, and a short timeframe to production based on access to existing rail and port infrastructure. These advantages, and the potential for future expansion, make Mayoko-Moussondji a stand-out development opportunity."

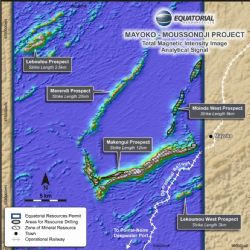

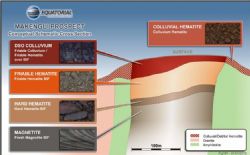

The Scoping Study was completed by Equatorial's Project Management Team under the direction of Rainer Dreier of Camco Dreico Industrial Services Pty Ltd ("CDIS"). The Scoping Study was based on the initial Mineral Resource Estimate ("MRE") for Mayoko-Moussondji which included an Indicated and Inferred Hematite Resource of 102 million tonnes at 40.6% Fe as part of an initial Indicated and Inferred Resource (Magnetite and Hematite) of 767 million tonnes at 31.9% Fe (refer ASX announcement 4 February 2013). The Scoping Study investigated Equatorial's three stage development plan for Mayoko-Moussondji incorporating both the hematite and magnetite components of the maiden resource. Equatorial engaged WorleyParsons Services Pty Limited ("WorleyParsons") to complete an independent review, optimisation and gap analysis of the first two development stages which envisage the development of a 2 million tonne per annum ("2Mtpa") operation based on the initial Indicated and Inferred Hematite Resource. This announcement contains only the Scoping Study results for these two stages (1 and 2). Orelogy Pty Ltd ("Orelogy") has provided the revised mining schedule and estimated mine operating costs with WorleyParsons providing sign off for the Class 1 capital cost estimate (excluding owners costs) and for operating costs including process, rail, port, and general and administrative expenses ("G&A").

The Company plans to produce a "Mayoko Premium Fines" iron product grading 64.1% Fe from the Project, commencing at 500Ktpa during Stage 1 and ramping up within 18 months to 2Mtpa during Stage 2. Based on the initial Hematite Resource the operating life of mine is estimated at 23 years. The first 6 years of mining are based on indicated mineral resource (representing 25% of the total mineral resource inventory), with the remainder being inferred material. Operating cash costs are expected to average US$41 per tonne FOB Pointe-Noire over the life of the mine.

The initial capital expenditure required for first production has been estimated at US$114 million. The total capital cost required to achieve 2Mtpa is estimated at US$231 million. The total capital cost could be reduced through leasing arrangements on rolling stock, improvements in tailings management and through partnership opportunities with neighboring company Exxaro Resources Limited ("Exxaro").

To View the full scoping study, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-EQX-641877.pdf

Contact

Equatorial Resources Limited

T: +61-8-9322-6322

F: +61-8-9322-6558

WWW: www.equatorialresources.com.au

| ||

|