Westpac-Melbourne Institute

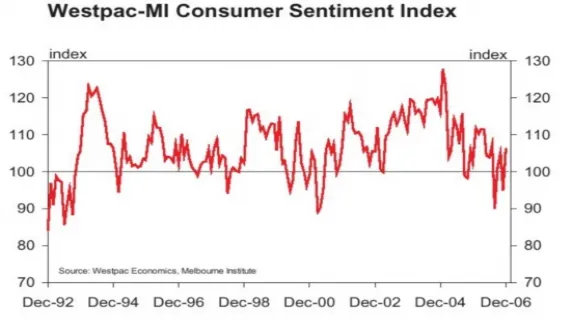

Melbourne, Dec 13, 2006 AEST (ABN Newswire) - The Westpac Melbourne Institute Index of Consumer Sentiment rose by 11.8% in December from 95.0 in November to 106.2 in December.

Westpac's Chief Economist, Bill Evans commented, "This is a surprisingly strong result. We expected that there would be some rebound from the 9.7% fall in November but did not anticipate such a strong recovery. The Index is now actually 1% above the October level, prior to the interest rate increase which the Reserve Bank announced in November."

Podcast:

http://abnnewswire.net/press/en/34455/Westpac.html

The three previous interest rate increases in March last year, and May and August this year established a fairly standard pattern where Sentiment fell sharply following the rate hike announcement but subsequently recovered when there was no immediate follow-up hike. However, the recovery was never enough to fully offset the original fall. This recovery, being more than enough to offset the original fall, points to a consumer who expects to cope surprisingly comfortably with the latest interest rate increase.

The key to this result is probably found with the continuing strong labour market. Prior to the survey it was announced that 36,200 new jobs had been established in November and the unemployment rate had consolidated at a 30 year low of 4.6%. Further evidence that the interest rate rise was not biting came from the extraordinary 16.7% jump in the confidence of mortgagees. Despite three interest rate increases in 2006, the confidence of mortgagees has actually risen by 5.2% over the year.

With optimists now outnumbering pessimists by a comfortable margin, prospects for a strong finish to the Christmas retail season have improved dramatically. The outlook for housing has also improved. Rising interest rates had reduced confidence in whether now is the "time to buy a dwelling" by 14% over the first nine months of the year. However, despite a further rate increase in November, the Index rose by a modest 1% from its September reading.

There was also a rise of 2.7ppts in the proportion of respondents who saw real estate as the wisest place for savings - increasing from 17.9% in September to 20.6% in December. That contrasted with falls in sentiment towards deposits and equities.

All components of the Index rose sharply. Confidence about family finances compared to a year ago was up 5.7% and expectations on finances over the next twelve months were up 9.4%. Confidence about economic conditions over the next twelve months was up by 28% and over the next five years by 5.2%. The best news for retailers was that confidence in whether now is a good time to buy a major household item rose by 11.9%.

Westpac continues to expect the Reserve Bank to raise interest rates again, following the Board meeting on February 6. Our consistent view has been that core inflation pressures are continuing to build in the economy and there will be insufficient evidence that the previous three rate increases have slowed the economy enough to give the Bank confidence that inflation will slow.

"Evidence from this survey certainly points to a more buoyant consumer than had generally been expected" Mr Evans said.

Contact

Bill Evans

Chief Economist

TEL: +61 (0) 2 8254 8531

| ||

|