It's a way for both the lender, and the person providing the loan or borrowed item, to have some security around the arrangement, and avoid prickly relationship issues when things go wrong.”— Blake McKenzieSYDNEY, NSW, AUSTRALIA, September 23, 2024 /EINPresswire.com/ -- As Australia faces a rising cost of living crisis and escalating interest rates, the economic pressure on households is more worrying than ever. With more than 40% of people globally lacking access to reliable credit and financial services, many Australians are turning to family and friends for financial support, a practice that can often lead to strained relationships and misunderstandings.

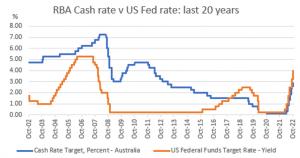

And despite the US Federal Reserve last week cutting interest rates in the world's biggest economy, banking experts here predict our RBA to keep rates on hold for now.

Commenting on US rate cuts, Westpac's Head of International Economics, Elliot Clarke, says:

"The decision to cut by 50bp certainly emphasises that the global policy cycle has turned and central banks are increasingly mindful of the downside risks for growth and the labour market, as well as keeping inflation on its path back to target. But each country needs to proceed based on their individual circumstances.

"Australia's labour market continues to show strength with employment growth keeping pace with historically elevated population growth and record labour force participation. While that remains the case, inflation risks will remain more probable and thus the RBA's focus."

The sentiment will only add to the pressure many Australian households are feeling right now. Over 3 billion people worldwide have limited or no access to traditional financial services and credit facilities, often relying on the goodwill of peers, family, and friends for financial assistance and the borrowing of essential goods. Unfortunately, predatory and payday lenders exploit millions of these individuals by offering short-term credit with exorbitant repayment terms, high interest rates, and severe penalties. Peer-to-peer lending has grown into a multi-billion-dollar industry, yet it operates with little to no governance.

And increasingly, struggling Australians find themselves with little choice but to ask friends or family for help as bills mount and the price of every day goods remain high. And this increases the risk of relationship breakdowns when struggling friends find themselves unable to repay.

Recent high-profile cases, such as one from New Zealand, have spotlighted the risks of unstructured agreements. A woman found herself in court after her partner failed to fulfill commitments, leading to significant personal disruption. The legal system, however, struggled to enforce these informal arrangements, highlighting the urgent need for clarity and accountability in personal transactions.

Tribunal referee Krysia Cowi stated: ‚ÄúPartners, friends, and colleagues make social arrangements, but it is unlikely they can be legally enforced unless the parties perform some act that demonstrates an intention that they will be bound by their promises.‚ÄĚ

In response to this pressing need, Kontrak Social has emerged as a promising solution. Kontrak Social provides that crucial demonstration of intention, offering a clear, enforceable agreement between parties. This innovative Australian app aims to facilitate secure, transparent agreements among peers, offering a structured approach to social contracts involving cash, goods, and services. By addressing the often fraught dynamics of informal lending, Kontrak Social seeks to reduce the financial stress that contributes to nearly 60% of relationship breakdowns. A standout feature, Tally Cat, provides trust scores based on past performance, allowing users to evaluate potential lending partners and fostering a culture of accountability that goes beyond mere goodwill.

In a landscape where many rely on the "bank of mum and dad" for financial assistance, or where predatory lenders take advantage of vulnerable individuals, Kontrak Social offers a community-centric alternative. The app not only streamlines borrowing and lending but also promotes a culture of bartering and skill-sharing, essential components of a resilient economy.

As the pressures of modern life mount, Kontrak Social represents a shift towards a more supportive and transparent financial ecosystem. It empowers Australians to help one another, transforming how we engage in financial transactions during these challenging times.

Kontrak Social CEO Blake McKenzie says the app is designed to help those with limited or no access to normal avenues of help. "It's a way for both the lender, and the person providing the loan or borrowed item, to have some security around the arrangement, and avoid prickly relationship issues when things go wrong."

Kontrak Social is available on Android and Apple devices an is a free app.

Jay Pring

Kontrak Social

+61 405 133 517

email us here

Visit us on social media:

LinkedIn

Instagram

TikTok

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.