Cobalt Nickel Refinery Progress

Cobalt Nickel Refinery Progress

Sydney, April 2, 2024 AEST (ABN Newswire) - Cobalt Blue Holdings Limited ( ASX:COB) (

ASX:COB) ( COH:FRA) (

COH:FRA) ( CBBHF:OTCMKTS) is developing the first Cobalt Sulphate Refinery (Refinery Project) in Australia.

CBBHF:OTCMKTS) is developing the first Cobalt Sulphate Refinery (Refinery Project) in Australia.

Recent milestones achieved:

- Large-scale feedstock samples sourced from third parties have been processed

- Potential offtake partners have begun to assess larger-scale sulphate samples produced from these sources

- Detailed engineering design has commenced

- Permitting on target for submission mid-2024

Workstreams are on track for a Q3 2024 decision to proceed to construction.

COB and Iwatani Australia will jointly market the Refinery Project at the upcoming annual Cobalt Institute Conference (13-14 May 2024).

COB is targeting both the US Inflation Reduction Act (IRA) and EU Critical Raw Materials Act (CRMA) compliance for its products. We believe that the timing of the Refinery Project is ideal as US/ EU market demand will hit an inflection point in the coming years.

COB published a Cobalt-Nickel Refinery Study presenting a compelling evaluation of a refining business that is expected to generate stable margins throughout the highs and lows of the cobalt price cycle.

Joe Kaderavek, CEO Cobalt Blue commented "Refinery Project development is progressing well, and we remain on pace to see construction commence by the end of this year. There is significant interest from WA State and Australian Commonwealth governments, along with international commercial parties in the emergence of a new midstream critical mineral capacity in Australia for the global battery supply chain."

Testwork

COB has secured 10 tonnes of feedstocks from global third parties for trial in our (Broken Hill based) Demonstration Plant.

Work continues to optimise the key unit operations, including:

1. leaching;

2. trace metal removal;

3. cobalt separation by solvent extraction;

4. cobalt sulphate crystallisation; and

5. nickel recovery.

The plant is operating on a continuous basis, with ability to trial parameters and equipment settings. Weekly programs target specific unit operations.

Following recent meetings with prospective offtakers in Japan, target levels for non-metallic elements were set. For example, a required target content of calcium, magnesium and sodium in the cobalt sulphate was provided. Hence, modifications to the solvent extraction circuit have been trialled to meet the required carry-over of magnesium, calcium and sodium into the cobalt sulphate product. The Japanese battery industry is generally considered to have stringent offtake specifications, and we believe these trials will place COB in a strong position to engage with a broader range of global partners as a result.

The feedstock secured represents the targeted third-party materials COB expects to source for its future Kwinana-based commercial operations. COB intends to market this large-scale sample production to kick off the qualification process, that will then be carried over to by the commercial plant when operations begin.

A photo of a recent batch of cobalt sulphate is shown below*. Approximately 30 kg was produced from a single crystallisation run.

Engineering

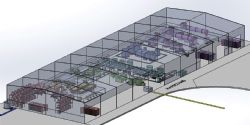

COB has commenced the detailed engineering design. The process engineering design package will be completed by COB.

External consultants will be engaged for civils, structural, electrical and instrumentation design. Efforts continue to select the preferred construction and management partner for the project.

Feed Supply

COB is aiming to execute initial feedstock contracts by mid-2024. Supply must adhere to strict criteria, and COB will only source from suppliers that:

- do not contravene USA Foreign Entities Of Concern (FEOC) definitions; and

- meet appropriate environmental and labour standards; and

- permit traceability/authentication to validate origin and supply chain custody.

Offtake Contracts

COB is aiming to secure initial offtake contracts by mid-2024. A key risk for offtake contracts is the validation of these high purity chemicals into the manufacturing supply chain. COB continues to build on existing deep relationships with precursor cathode active material (pCAM) manufacturers, to optimise product specifications including contaminant trace metals, physical handling and moisture content, logistics supply and product storage requirements. Strategies are being developed to streamline validation once the Refinery Project plant has been constructed.

COB continues to develop a relationship with Iwatani Australia and will jointly market the Cobalt-Nickel Refinery at the upcoming Cobalt Institute conference in New York ("Cobalt Congress 2024") 13-14 May 2024.

Permitting

ABEC/Green Values has been appointed to prepare permit applications for the Refinery Project. A Works Approval for the existing Iwatani Australia license will be sought from the Department of Water and Environmental Regulation (DWER) Western Australia. The necessary background studies include assessment of air emission, waste management and use/storage/management of hazardous substances. COB is intending to submit the application by mid-2024 to DWER.

IRA compliant material - deficit emerging

COB is targeting both the US Inflation Reduction Act (IRA) and EU Critical Raw Materials Act (CRMA) compliance for its products.

We believe that the timing of the Refinery Project is ideal as US/EU market demand will hit an inflection point in the coming years.

In the US, FEOC exclusion criteria are scheduled for implementation from 1 Jan 2025 (subject to an industry consultation period of up to 6 months), with any FEOC material content effectively excluding the Electric Vehicle maker from any benefit under the IRA. According to our analysis, from 2026, only 55% of the US supply requirement will be compliant - and this share will decline as EV sales grow.

During the second half of this decade, global demand growth for cobalt will exceed supply growth for the fore-seeable future. Cobalt output has seen significant growth as a result of a deep pipeline of operational expansions and greenfield development in the Democratic Republic of Congo and Indonesia. As this extraordinary period of growth eases, a steady demand growth profile will likely create substantial market deficits and bring cobalt prices back over time to long-term averages.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/9O4KK7Q2

About Cobalt Blue Holdings Limited

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:COB) (

ASX:COB) ( COH:FRA) (

COH:FRA) ( CBBHF:OTCMKTS) is developing the first Cobalt Sulphate Refinery (Refinery Project) in Australia.

CBBHF:OTCMKTS) is developing the first Cobalt Sulphate Refinery (Refinery Project) in Australia.  Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.