Response to Marmota Limited Claims

Response to Marmota Limited Claims

Adelaide, Aug 3, 2023 AEST (ABN Newswire) - Barton Gold Holdings Limited ( ASX:BGD) and its subsidiary Challenger 2 Pty Ltd (Barton or the Company) provide the following response to claims published by Marmota Limited (

ASX:BGD) and its subsidiary Challenger 2 Pty Ltd (Barton or the Company) provide the following response to claims published by Marmota Limited ( ASX:MEU) (Marmota) and its subsidiary, Half Moon Pty Ltd (HMP) related to the Western Gawler Craton JV (JV) and JV agreement (JVA).

ASX:MEU) (Marmota) and its subsidiary, Half Moon Pty Ltd (HMP) related to the Western Gawler Craton JV (JV) and JV agreement (JVA).

On 13 July 2023 Marmota advised the ASX that it and HMP have detailed certain claims against Barton in a letter said to be a pre-action notice. Barton has today responded in full to this letter. Barton rejects these claims, considers them to be without merit, and will vigorously defend any proceedings.

Background

In 2019 the Company became party to the JV, and also to a September 2016 'Dispute Settlement Term Sheet' (Term Sheet) which settled a prior dispute regarding which tenements were included in the JV. The Term Sheet affirmed that the northern portion of EL6502, and ML6103 and ML6457 do not form part of the JV, that the other tenements in the JV would be formally transferred to HMP's ownership for $100, and importantly that the Term Sheet is binding on the parties until replaced by subsequent documentation.

When the Company became a party to the JV, HMP required it to agree that the Term Sheet remained binding. In July 2020, HMP notified Barton that it would delay implementation of the Term Sheet until after a pending sale of HMP was completed, acknowledged that it was frustrating Barton's efforts to implement the Term Sheet in a timely fashion, and affirmed that it could be implemented after HMP's pending sale.

Term Sheet Binding

However, in March 2021, after Marmota agreed to acquire HMP, it reversed its longstanding position and asserted that the Term Sheet had 'expired' due to delays in implementation, and was no longer binding.

Barton rejected this position on several grounds, including that the Term Sheet explicitly provides that it is binding until replaced, and so cannot 'expire', and that HMP itself caused the delay in implementation.

Marmota also claimed the Term Sheet 'expired' "because Ministerial Consent... was formally refused", or it "was incapable of ever being enacted under the Mining Act... (which did not allow for splitting of tenements)."

These claims are plainly incorrect as Barton has previously detailed in prior Quarterly Activities Reports.

Marmota's recent claims are silent on the Term Sheet's status, do not refute Barton's bases for rejecting HMP's new position, and do not address its prior incorrect statements. Instead, they now focus on the issue of access to the tenements which it would have owned but for its repudiation of the Term Sheet.

Barton contends that HMP is barred from asserting that the Term Sheet has 'expired' when the cause of the alleged 'expiry' is because HMP refused to implement its terms, and that HMP has now repudiated the term sheet because it believes there is an alternative commercial benefit to be obtained by doing so.

Historical Gold Production on ML6457

HMP now asserts a JV interest in historical ML6457 gold production. Barton considers this claim to be flawed and based solely upon HMP's repudiation of the Term Sheet. ML6457 was developed by Barton's predecessor in title in reliance upon the Term Sheet, and operated only briefly during 2018.

Barton also understands that only 545.1 ounces of gold were produced from ML 6457. Therefore, even if HMP is able to establish a claim, its pro-rata share of the gold value produced would likely be considerably less than its pro-rata liability to historical costs, which Barton would then seek by way of counterclaim.

Access & Marmota's damages claim

Barton rejects the claim that it improperly restricted JV tenement access. In South Australia a tenement owner bears statutory liability for the conduct of exploration activities on that land. For this reason, formal access agreements are a standard industry practice where a party proposes to undertake exploration activities on a tenement which it does not own. Notwithstanding the ongoing Term Sheet dispute, Barton has offered HMP access subject only to a standard access agreement. HMP has consistently refused.

The JVA also specifically requires HMP to sign a 'Co-ordination Deed' "regulating the conduct of exploration activities... on the Tenements", consistent with standard access agreements. HMP recognised this and, until Barton's predecessor in title entered voluntary administration in 2018, pursued such a deed.

HMP could have gained access to the tenements at any time, either by implementing the Term Sheet (which it remains obligated to do), or by accepting Barton's offer of a standard access agreement.

Joint Venture Costs

Marmota suggests that Barton has failed to cover its share of JV costs. Barton has paid all JV costs due and any suggestion to the contrary is false.

Offer to Settle

In December 2022 Barton offered a settlement to Marmota and HMP, but received no reply. In an attempt to resolve these issues without litigation, Barton has again offered Marmota and HMP a settlement which it believes is commercially attractive and superior to any outcome that they could reasonably anticipate through litigation. Barton's offer is open for acceptance until 5.00pm ACST on Thursday, 31 August 2023.

Commenting on the matter, Barton MD Alex Scanlon said:

"We would not normally provide detailed comment regarding threatened litigation, however Marmota's recent claims require a clear response. These claims are without merit and are of the claimant's own making. "Further, only minimal gold was produced from ML6457. Its cost likely exceeds its value many times over, and if Marmota persists in this claim we anticipate that it will become liable to Barton for several million dollars.

"We are not interested in a protracted dispute and so in good faith have again offered an amicable resolution. However, if obliged to respond to proceedings we will vigorously defend our rights and bring a significant counterclaim."

About Barton Gold Holdings Limited

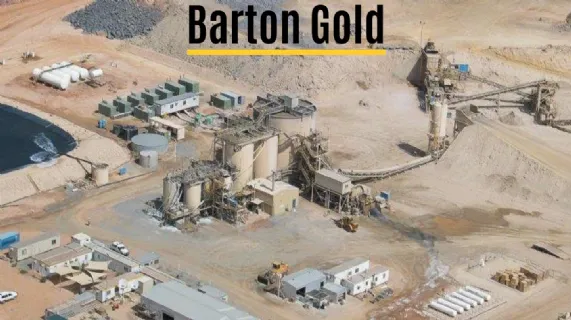

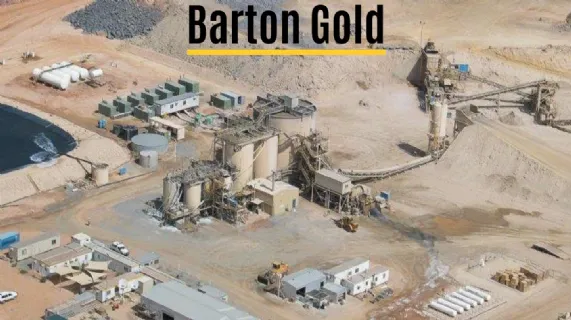

Barton Gold Holdings Limited (ASX:BGD) (FRA:BGD3) (OTCQB:BGDFF) is an ASX listed Australian gold exploration company with a total attributable ~1.1Moz Au JORC (2012) Mineral Resources endowment (28.74Mt @ 1.2 g/t Au), a pipeline of advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the central Gawler Craton of South Australia.

Barton Gold Holdings Limited (ASX:BGD) (FRA:BGD3) (OTCQB:BGDFF) is an ASX listed Australian gold exploration company with a total attributable ~1.1Moz Au JORC (2012) Mineral Resources endowment (28.74Mt @ 1.2 g/t Au), a pipeline of advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the central Gawler Craton of South Australia.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BGD) and its subsidiary Challenger 2 Pty Ltd (Barton or the Company) provide the following response to claims published by Marmota Limited (

ASX:BGD) and its subsidiary Challenger 2 Pty Ltd (Barton or the Company) provide the following response to claims published by Marmota Limited ( ASX:MEU) (Marmota) and its subsidiary, Half Moon Pty Ltd (HMP) related to the Western Gawler Craton JV (JV) and JV agreement (JVA).

ASX:MEU) (Marmota) and its subsidiary, Half Moon Pty Ltd (HMP) related to the Western Gawler Craton JV (JV) and JV agreement (JVA).  Barton Gold Holdings Limited (ASX:BGD) (FRA:BGD3) (OTCQB:BGDFF) is an ASX listed Australian gold exploration company with a total attributable ~1.1Moz Au JORC (2012) Mineral Resources endowment (28.74Mt @ 1.2 g/t Au), a pipeline of advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the central Gawler Craton of South Australia.

Barton Gold Holdings Limited (ASX:BGD) (FRA:BGD3) (OTCQB:BGDFF) is an ASX listed Australian gold exploration company with a total attributable ~1.1Moz Au JORC (2012) Mineral Resources endowment (28.74Mt @ 1.2 g/t Au), a pipeline of advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the central Gawler Craton of South Australia.