DECLARATION OF WIND DEVELOPMENT AREA 0EI-01-2023 - NO MATERIAL IMPACT ON PEP 11 TITLE

PEP11 Update

Perth, July 21, 2023 AEST (ABN Newswire) - Asset Energy Pty Ltd, wholly owned subsidiary of Advent Energy Limited, an investee of BPH Energy Ltd ( ASX:BPH) and Bounty Oil & Gas NL (

ASX:BPH) and Bounty Oil & Gas NL ( ASX:BUY), report that on 14 July 2023; the Hon Chris Bowen, Minister for Climate Change and Energy, gazeted/designated an area of the Pacific Ocean area off the Hunter Region of NSW as suitable for offshore wind energy development and that it would be open for industry to develop wind farms. It will become Australia's second official offshore wind energy zone.

ASX:BUY), report that on 14 July 2023; the Hon Chris Bowen, Minister for Climate Change and Energy, gazeted/designated an area of the Pacific Ocean area off the Hunter Region of NSW as suitable for offshore wind energy development and that it would be open for industry to develop wind farms. It will become Australia's second official offshore wind energy zone.

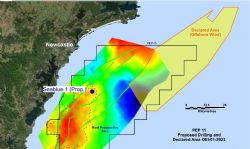

Having reviewed the PEP 11 seismic data and the drill data from the Seaclem 1 well (See map below); the Declared Wind Area does not materially impact the PEP 11 tle or the main PEP 11 target areas.

Asset Energy and Bounty welcome this declaration/gazetal as it reinforces our belief that decarbonising the global energy system will require the use of a mixture of technologies encompassing renewable energy resources, carbon sequestration and natural gas.

There are and will be offshore areas where wind, gas and carbon sequestration activities will overlap and it is Advents' belief that a holistic approach should and will be taken to ensure that clean energy is produced in a reliable and cost effective manner.

In April of this year Assets' parent company Advent Energy made a submission to the consulta on website of the Department of Climate Change, Energy, the Environment and Water on the proposed Hunter offshore wind development area.

https://consult.dcceew.gov.au/oei-hunter/have-your-say/view/1906

Advent has had preliminary discussions to explore synergies with one of the wind technology companies who are planning to tender for and develop part of the Declared area and has scheduled further consultation.

EXTENSION AND VARIATION APPLICATIONS FOR PEP-11 PERMIT TO ENABLE DRILLING OF SEABLUE GAS WELL AT BALEEN

Asset Energy con nues to progress the joint venture's applications for the varia on and suspension of work program conditions and related extension of PEP-11. This application follows from the fact that in February 2023 a decision by the previous Commonwealth-NSW Joint Authority to refuse the application was quashed by the Federal Court of Australia. Asset has provided additional updated information to the Commonwealth-NSW Joint Authority and title authority (NOPTA) in relation to its applications.

While the applications for the variation and suspension of work program conditions and related extension of PEP-11 are being considered by NOPTA, Asset is investigating the availability of a mobile offshore drilling unit to drill the proposed Seablue-1 well on the Baleen prospect which would take approximately thirty-five days to complete. Asset is in communication with drilling contractors and other operators who have recently contracted rigs for work in the Australian offshore beginning in the first half of 2024.

PEP-11 continues in force and the Joint Venture is in compliance with the contractual terms of PEP11 with respect to such maters as reporting, payment of rents and the various provisions of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (Cth).

THE IMPORTANCE OF NEW GAS PROJECTS AND EAST COAST AUSTRALIA GAS SUPPLY

The analysis contained in the Australian Competition & Consumer Commission Gas inquiry 2017-2030 interim report (January 2023) (ACCC Report ) emphasises that from 2026 there will be a material shortfall of supply in gas in the Australian east coast gas market.

"From 2026 onwards the east coast gas market is expected to experience a shortfall in supply from [proved and probable (2P)] reserves unless additional supply comes online. Under a Step Change scenario for gas demand [which models a steep decline in gas demand], the shortfall may be deferred until 2027. However, in the long-term there is not expected to be sufficient gas production from 2P reserves to meet demand, as demand is expected to decline over the longer-term through a shift to greater electrification and as energy policy shifts towards net-zero emissions targets. However, natural gas will likely be part of the transition between coal power generation and renewable energy sources, and there will be ongoing need for gas from commercial and industrial users in particular.

Without expansion in production, gas supply shortfalls are expected arising from export and domestic demand even under a Step Change scenario in which there are greater shifts to electrification, consistent with net-zero emissions targets. This would place continued upward pressure on prices in the gas market, as well as pressure on the electricity market through the role that gas powered generation will likely play in meeting peak electricity demand and maintaining the stability of the east coast energy system.

Additional gas supply will be needed to avoid future shortfalls.

The analysis of the ACCC is reflected by the recent representa ve public comments of senior Commonwealth Government Ministers.

(a) The Prime Minister the Hon Anthony Albanese MP said that "gas will play a role in renewables" when defending the role that gas will play in the transition to clean energy.

(b) The Hon Madeleine King MP correctly noted that:

"In the short term, medium term and long term we will need gas. You need gas to process critical minerals and rare earths which are essential for clean energy technology."

(c) The Hon Chris Bowen MP said that:

"Gas is a flexible fuel necessary for peaking and firming as we undertake this transformation [to the government's renewables target".

(d) The Hon Dr Jim Chalmers MP noted that the gas industry is a "really important" part of the nation's economy, and that the Commonwealth Government is working on increasing gas supply.

The views of the ACCC are reflected within industry. Dr Kerry Schot (the former head of the Energy Security Board) recently observed that the pathway to net zero emissions is not realistic without further gas supply. A similar observation has been atributed to Mr Adrian Dwyer (CEO of Infrastructure Partnerships Australia). The Australian Petroleum Production and Exploration Association has also observed the need for Australia to increase its domestic gas supply in light of the shortfall projections noted above.

Closely related to the need for Australia to have new gas supply is the fact that a lack of gas supply is a key driver of inflation. As Dr Phillip Lowe, the Governor of the Reserve Bank of Australia, said in a Senate Estimates Hearing:

"One way of tackling inflation induced by supply-side shocks is to address the supply side. At the moment there are two areas I think we could be focusing on. It's the supply of gas and electricity in the domestic market-what we can constructively do to increase the supply. I don't want to get drawn into what the right measures are, but just at the analytical level, increased supply of gas and electricity in the domestic market would be helpful to combat rising energy prices."

Asset Energy is the Operator of PEP-11 with an 85% interest, the remaining 15% interest is held by Bounty Oil & Gas NL ( ASX:BUY).

ASX:BUY).

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/B089AF3L

About BPH Energy Limited

BPH Energy Limited (ASX:BPH) is an Australian Securities Exchange listed company developing biomedical research and technologies within Australian Universities and Hospital Institutes.

BPH Energy Limited (ASX:BPH) is an Australian Securities Exchange listed company developing biomedical research and technologies within Australian Universities and Hospital Institutes.

The company provides early stage funding, project management and commercialisation strategies for a direct collaboration, a spin out company or to secure a license.

BPH provides funding for commercial strategies for proof of concept, research and product development, whilst the institutional partner provides infrastructure and the core scientific expertise.

BPH currently partners with several academic institutions including The Harry Perkins Institute for Medical Research and Swinburne University of Technology (SUT).

| ||

|