Acquisition of Canadian Lithium Projects & Placement

Acquisition of Canadian Lithium Projects & Placement

Melbourne, May 25, 2023 AEST (ABN Newswire) - Cohiba Minerals Limited ( ASX:CHK) (

ASX:CHK) ( CHKMF:OTCMKTS) is pleased to announce that it has executed a binding agreement (Agreement) to acquire Maple Minerals 2 Pty Ltd (Maple Minerals) (Proposed Acquisition). Maple Minerals holds the rights to acquire four (4) lithium and rare earth element (REE) properties in Ontario, Canada.

CHKMF:OTCMKTS) is pleased to announce that it has executed a binding agreement (Agreement) to acquire Maple Minerals 2 Pty Ltd (Maple Minerals) (Proposed Acquisition). Maple Minerals holds the rights to acquire four (4) lithium and rare earth element (REE) properties in Ontario, Canada.

Highlights:

- Acquisition of four (4) strategically located lithium projects with a combined 148km2 within known lithium terranes.

- Properties occur in terranes which host major lithium resources including Green Technology Metals' ( ASX:GT1) flagship Seymour Lake Lithium Project (9.9Mt @ 1.04% Li20) and Rock Tech Lithium's (

ASX:GT1) flagship Seymour Lake Lithium Project (9.9Mt @ 1.04% Li20) and Rock Tech Lithium's ( CVE:RCK) Georgia Lake Project (10.6Mt Indicated @ 0.88% Li20 and 4.2Mt Inferred @ 1.00% Li20)

CVE:RCK) Georgia Lake Project (10.6Mt Indicated @ 0.88% Li20 and 4.2Mt Inferred @ 1.00% Li20)

- Projects also demonstrate strong potential for rare earth element (REE) mineralisation.

- Placement to sophisticated investors to raise $1,750,000 (before costs)

- Cohiba will be fully funded to conduct a comprehensive field exploration program this northern summer over all four projects

- Company to engage consultants to commence a field exploration program over all four projects with commencement following completion of the acquisition

The Maple Minerals project portfolio consists of:

- The Big Rock Lithium Property comprising 9 claims for 3,611 hectares;

- The Rogers Creek Lithium Property comprising 10 claims for 4,642 hectares;

- The Ottertail Lithium Property comprising 7 claims for 2,690 hectares; and,

- The Gathering Lake Lithium Property comprising 9 claims for 3,897 hectares.

The Proposed Acquisition is subject to CHK shareholder approval which is required for the issue of Consideration Shares and Consideration Performance Rights (each defined below) and the Tranche 2 Placement shares (defined below*) (the Tranche 1 Placement shares will be issued without shareholder approval).

As a condition of the Proposed Acquisition, the Company has also received firm and irrevocable commitments from professional and sophisticated investors for a capital raising of $1.75 million (before costs) (Placement), to be conducted in two tranches.

Cohiba's CEO, Andrew Graham says, "We are delighted to have been able to execute binding agreements for this acquisition and secure these strategic tenements within known lithium and rare earth element terranes.

North-west Ontario is recognised as a key lithium Province and with highly attractive geological and structural precursors within close proximity to known lithium resources we are confident of yielding exploration success.

Canada is forecast to be a significant supplier of critical minerals, including lithium, which is evidenced through the recent deal between Green Technology Metals (GT1) and LG Energy Solutions (LGES) which saw LGES invest AUD$20 million in GT1 to become a substantial shareholder and major offtake partner. Following an extensive due diligence process we are confident that we have secured an exceptional portfolio of projects and look forward to undertaking some detailed reconnaissance work in the upcoming summer season."

Proposed Work Program

The Company will undertake a comprehensive field investigation during the upcoming summer season using the services of local Geological Consultants which have expertise in the delivery of these programs within lithium terranes across Canada. Below is an estimated timeline for the program:

July - September 2023:

- Detailed review of historical data (geology, geophysics, petrology, mineralogy, geochemistry etc.),

- Detailed geological mapping,

- Comprehensive and systematic geochemical sampling program,

- Review of field data and associated reporting,

- Recommendations for follow-up work including aeromagnetics and multispectral analysis,

- Ongoing program design including target prioritisation; and,

- Completion of necessary statutory documents.

December 2023

- Aeromagnetic and multispectral surveys (depending on recommendations); and,

- RC drilling over strategic targets.

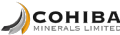

Big Rock Lithium Property

The Big Rock Lithium Property is located in north-western Ontario (Figure 1*) where a number of significant lithium deposits have already been delineated including Green Technology Metals ( ASX:GT1) Seymour Project which has an existing Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O.

ASX:GT1) Seymour Project which has an existing Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O.

The Big Rock Lithium Property is hosted largely by mafic metasedimentary rocks in close association with a peraluminous, S-type, fertile granite pluton. Regional faults transecting the property are recognised as providing excellent pathways and fracture systems for granitic parental melts.

Minor work has been completed over the property in recent times with the last major reconnaissance survey in 1931 identifying multiple pegmatites which, at that time, were not assessed for lithium and rare earth element occurrences.

The major lithium deposits of north-western Ontario are located within 20km of a terrane boundary. These terrane boundaries are recognised as deep-seated sutures that divide accreted Archaean terranes and act as conduits for fertile peraluminous granitic melts. The Big Rock Lithium Property lies within 17km of the English River - East Wabigoon Terrane boundary (Figure 2*).

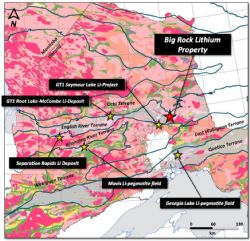

Rogers Creek Lithium Property

The Rogers Creek Lithium Property is located in north-western Ontario (Figure 3*) approximately 45km east of the Georgia Lake pegmatite field which has been recognised as having the largest concentration of rare earth element mineralisaton in the Superior Province, Quebec.

The property is hosted by a muscovite-bearing granite which has been identified as an S-type, peraluminous fertile parental granite. This granite is in contact with metasedimentary units which provides an ideal host environment for pegmatites. The Long Lac Fault and associated secondary structures provide the necessary pathways for granitic melts and pegmatite deposition.

Regional mapping in 1939 and 1970 documented several white and pink pegmatites in the vicinity of the Property both within the peraluminous granites and the metasedimentary units indicating possible fractionating pegmatite activity.

The property occurs within 13km of the East Wabigoon - Quetico Terrane boundary (Figure 4*) which provides further support for the exploration potential of this location.

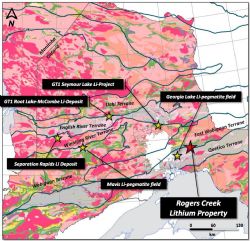

Ottertail Lithium Property

The Ottertail Lithium Property is located in north-western Ontario (Figure 5*) approximately 90km north-west of Nakina within the same geological setting as the Superb Lake pegmatite field which is known principally for its spodumene bearing lithium and niobium / tantalum mineralisation.

The property is hosted along the limb of a major fold sequence and along the contact of a metasedimentary unit and a fertile, peraluminous parental granite which provides the ideal environment for exomorphic dispersion in the host rocks adjacent to rare-element pegmatites. Regional faulting and dilational structures associated with folding provide excellent conduits for granitic parental melts.

In 2003 the Ontario Geological Survey (OGS) conducted a regional investigation of mineralisation associated with rare element pegmatites and related S-type, peraluminous granites within the Superior Province including the Superb Lake pegmatite field with the detection of fertile, peraluminous parent granites.

The property lies 17km south-east of the Uchi-English River Terrane boundary.

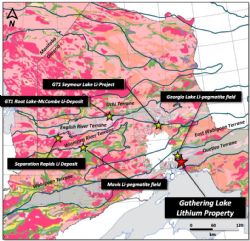

Gathering Lake Lithium Property

The Gathering Lake Lithium property is located in north-western Ontario (Figure 7) approximately 68km north-east of Nipigon and 25km east of the Georgia Lake pegmatite field which hosts several lithium deposits such as Rock Tech Lithium's Georgia Lake Lithium Project which comprises 10.60 million tonnes (Mt) Indicated Mineral Resource at a grade of 0.88% Li2O and 4.22 Mt of Inferred Mineral Resource at a grade of 1.0% Li2O as of 31 July 2022 .

The property is hosted along the contact a fertile peraluminous parental granite and metasedimentary units which make ideal exomorphic contact hosts for fractionating parental melts. Several north trending faults provide the necessary dilational structures.

The spodumene-bearing pegmatites of this area were first discovered in 1955 with the majority of historical exploration occurring between 1955 - 1958. Many of these pegmatites were drill tested in 1955 and 1956 with some additional drilling occurring in the 1980's and 1990's. The majority of pegmatites are hosted by Archaean metasediments near large peraluminous granites and are lithium-caesium-tantalum (LCT) type pegmatites with strong potential for other rare elements such as niobium, tantalum, rubidium, beryllium and caesium.

Work conducted by the Ontario Geological survey (OGS) in the 1970's identified several white garnetiferous and tourmalinised pegmatites which provided further evidence of the fertile nature of the granitic melts and the potential for significant fractionation leading to lithium-bearing pegmatite deposition.

The Gathering Lake Lithium property occurs within the Quetico Terrane (Figure 8) which has become a major focal point for exploration of clastic metasedimentary-hosted, rare-element pegmatite mineralisation.

Proposed Acquisition Terms

In consideration for the Proposed Acquisition of Maple Minerals, and subject to the terms and conditions of the Terms Sheet, consideration for the acquisition of the projects is as follows:

(a) issue of fully paid ordinary shares in the capital of the Purchaser (Shares) to the vendors (being the shareholders of Maple Minerals) (Vendors) of 50,000,000 Shares in aggregate (Consideration Shares);

(b) issue of unlisted performance rights to acquire Shares (Performance Rights) to the Vendors in the following tranches:

1. Unlisted performance rights (Tranche 1 Performance Rights) in the Purchaser of 62,500,000 Tranche 1 Performance Rights in aggregate. Tranche 1 Performance Rights convert to fully paid ordinary shares in the Company upon and subject to the Company discovering and reporting in accordance with the JORC code not less than five rock chip samples taken from the mining claims forming the projects at not less than 1% Li20 each.

If the milestone for the conversion of Tranche 1 Performance Rights is not achieved by 48 months then Tranche 1 Performance Rights shall automatically lapse. and

2. Unlisted performance rights (Tranche 2 Performance Rights) in the Company of 62,500,000 Tranche 2 Performance Rights in aggregate. Tranche 2 Performance Rights convert to fully paid ordinary shares in the Company upon and subject to the Company reporting in accordance with the JORC code a drill intercept or channel sample of not less than 10 metres at not less than 1% Li20. If the milestone for the conversion of Tranche 2 Performance Rights is not achieved by 48 months then Tranche 2 Performance Rights shall automatically lapse. (together, the Consideration Performance Rights).

The Consideration Shares and the Consideration Performance Rights will be issued to the Vendors in proportion to their holding of shares in Maple Minerals.

In accordance with the terms of the acquisition agreement which Maple Minerals has with the current holders of the projects, the Company will be required to pay the following additional consideration to the current holders of the projects:

(a) Cash consideration of CAD$259,000; and

(b) The grant of a 1.5% net smelter royalty (NSR) in respect of production of any minerals from the area within the boundaries of the claims comprising the projects. Post completion of the Transaction, the Company will have the ability to re-purchase 0.5% of the NSR for $500,000.

Placement

As a condition of the Proposed Acquisition, the Company has received firm and irrevocable commitments from professional and sophisticated investors for the placement of 350,000,000 fully paid ordinary shares (Shares) with an issue price of $0.005 (0.5 cents) per share.

The Company will also issue one free attaching CHKOB option for every one new Shares issued (Placement Option).

The Company will issue 153,000,000 Shares in accordance with its placement capacity under ASX Listing Rule 7.1 and 147,000,000 Shares under its placement capacity under ASX Listing Rule 7.1A (Tranche 1 Placement).

All Placement Options and the remaining 50,000,000 Shares will be subject to approval by shareholders at a general meeting to be held over the coming months (Tranche 2 Placement).

Proceeds from the issue will be used to fund the Proposed Acquisition, exploration costs on the Company's newly acquired projects and current projects and working capital requirements.

PAC Partners acted as lead Manager for the Placement and will received 40,000,000 CHKOB options as partial consideration for the Placement.

*To view timeline, tables and figures, please visit:

https://abnnewswire.net/lnk/5Y00V167

About Altair Minerals Limited

Altair Minerals Limited (ASX:ALR) (OTCMKTS:CHKMF) is listed on the Australian Securities Exchange (ASX) with the primary focus of investing in the resource sector through direct tenement acquisition, joint ventures, farm in arrangements and new project generation. The Company has projects located in South Australia, Western Australia and Queensland with a key focus on its Olympic Domain tenements located in South Australia.

Altair Minerals Limited (ASX:ALR) (OTCMKTS:CHKMF) is listed on the Australian Securities Exchange (ASX) with the primary focus of investing in the resource sector through direct tenement acquisition, joint ventures, farm in arrangements and new project generation. The Company has projects located in South Australia, Western Australia and Queensland with a key focus on its Olympic Domain tenements located in South Australia.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:CHK) (

ASX:CHK) ( CHKMF:OTCMKTS) is pleased to announce that it has executed a binding agreement (Agreement) to acquire Maple Minerals 2 Pty Ltd (Maple Minerals) (Proposed Acquisition). Maple Minerals holds the rights to acquire four (4) lithium and rare earth element (REE) properties in Ontario, Canada.

CHKMF:OTCMKTS) is pleased to announce that it has executed a binding agreement (Agreement) to acquire Maple Minerals 2 Pty Ltd (Maple Minerals) (Proposed Acquisition). Maple Minerals holds the rights to acquire four (4) lithium and rare earth element (REE) properties in Ontario, Canada.  ASX:GT1) flagship Seymour Lake Lithium Project (9.9Mt @ 1.04% Li20) and Rock Tech Lithium's (

ASX:GT1) flagship Seymour Lake Lithium Project (9.9Mt @ 1.04% Li20) and Rock Tech Lithium's ( CVE:RCK) Georgia Lake Project (10.6Mt Indicated @ 0.88% Li20 and 4.2Mt Inferred @ 1.00% Li20)

CVE:RCK) Georgia Lake Project (10.6Mt Indicated @ 0.88% Li20 and 4.2Mt Inferred @ 1.00% Li20)  ASX:GT1) Seymour Project which has an existing Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O.

ASX:GT1) Seymour Project which has an existing Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O.  Altair Minerals Limited (ASX:ALR) (OTCMKTS:CHKMF) is listed on the Australian Securities Exchange (ASX) with the primary focus of investing in the resource sector through direct tenement acquisition, joint ventures, farm in arrangements and new project generation. The Company has projects located in South Australia, Western Australia and Queensland with a key focus on its Olympic Domain tenements located in South Australia.

Altair Minerals Limited (ASX:ALR) (OTCMKTS:CHKMF) is listed on the Australian Securities Exchange (ASX) with the primary focus of investing in the resource sector through direct tenement acquisition, joint ventures, farm in arrangements and new project generation. The Company has projects located in South Australia, Western Australia and Queensland with a key focus on its Olympic Domain tenements located in South Australia.