A$4.5 Million Placement to Accelerate Lithium Exploration

A$4.5 Million Placement to Accelerate Lithium Exploration

Perth, Oct 27, 2022 AEST (ABN Newswire) - Monger Gold Ltd ( ASX:MMG) is pleased to announce that it has received firm commitments to raise A$4.5 million (before costs) from domestic and offshore institutional, sophisticated and professional investors under a two-tranche placement of fully paid ordinary shares ("New Shares") at an issue price of A$0.40 per share ("Placement").

ASX:MMG) is pleased to announce that it has received firm commitments to raise A$4.5 million (before costs) from domestic and offshore institutional, sophisticated and professional investors under a two-tranche placement of fully paid ordinary shares ("New Shares") at an issue price of A$0.40 per share ("Placement").

The Placement was strongly supported by new and existing investors from around the globe and reflects significant interest in Monger's portfolio of lithium assets located in the tier-1 mining jurisdictions of Canada and the United States.

Placement proceeds will be used for:

- Exploration field works at the Brisk and Trieste Lithium Projects;

- Potential additional acquisitions;

- Drilling at the Scotty Lithium Project; and

- General working capital.

Monger's CEO, Adam Ritchie, said:

"The strong demand shown from Australian and international investors in this Placement validates our strategy as we continue to acquire and explore highly prospective lithium projects in the tier-1 mining jurisdictions of Canada and the United States.

The introduction of a number of high-quality institutions, together with the support shown by existing long-term loyal shareholders, has ensured that Monger is well-capitalised to maintain momentum across its portfolio of lithium assets.

I look forward to our EGM on Monday 31st October and formalising our transition to Loyal Lithium ( ASX:LLI)."

ASX:LLI)."

Placement Details

The Placement will be issued in two tranches:

- Tranche one: the Company will issue 5.5 million New Shares at an offer price of A$0.40 per New Share, to raise a total of A$2.2 million (before costs) ("Tranche One Placement").

- Tranche two: subject to shareholder approval, the Company will issue 5.75 million New Shares at an offer price of A$0.40 per New Share, raising a total of A$2.3 million (before costs) ("Tranche Two Placement").

New Shares under the Tranche One Placement will be issued within the Company's existing placement capacity in accordance with ASX Listing Rule 7.1. Settlement of the Tranche One Placement is expected to occur on or around Tuesday, 1 November 2022.

Completion of the Tranche Two Placement is subject to shareholder approval, which will be sought at an Extraordinary General Meeting expected to be held in early December 2022. The issue price of A$0.40 per New Share represents a 16.7% discount to the closing price of MMG's shares on 20 October 2022 and a 7.5% discount to the 15-day Volume-Weighted Average Price.

Canaccord Genuity (Australia) Limited acted as Lead Manager to the Placement.

About Loyal Lithium Limited

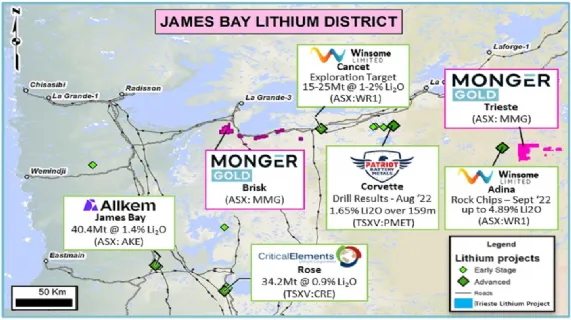

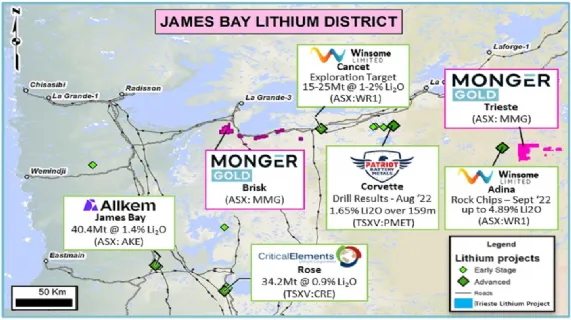

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:MMG) is pleased to announce that it has received firm commitments to raise A$4.5 million (before costs) from domestic and offshore institutional, sophisticated and professional investors under a two-tranche placement of fully paid ordinary shares ("New Shares") at an issue price of A$0.40 per share ("Placement").

ASX:MMG) is pleased to announce that it has received firm commitments to raise A$4.5 million (before costs) from domestic and offshore institutional, sophisticated and professional investors under a two-tranche placement of fully paid ordinary shares ("New Shares") at an issue price of A$0.40 per share ("Placement").  ASX:LLI)."

ASX:LLI)."  Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.

Loyal Lithium Limited (ASX:LLI) is a well-structured listed resource exploration company with projects in Tier 1 North American mining jurisdictions in the James Bay Lithium District in Quebec, Canada and Nevada, USA. Through the systematic exploration of its projects, the Company aims to delineate JORC compliant resources, creating value for its shareholders.