Chairman's Update Prior to the 2022 AGM

Chairman's Update Prior to the 2022 AGM

Sydney, Oct 12, 2022 AEST (ABN Newswire) - Ahead of this year's Annual General Meeting (AGM), which is to be held on 26 October 2022, I would like to take the opportunity to provide a brief update on Sugar Terminals Limited's ( NSX:SUG) recent activities and encourage shareholder participation at the AGM.

NSX:SUG) recent activities and encourage shareholder participation at the AGM.

In August 2022, STL announced another solid financial performance with profit growth of 2.7% to $27.9 million. This result is a continuation of the STL's Board careful, reliable and consistent stewardship of the business. Over the past five years, STL's share price has increased by more than 20% and the Company has delivered to shareholders average returns of 12.5%. At the same time, excluding insurance, STL's total operating costs were lower in FY22 than in FY18, which was the first year of the new business model - after allowing for inflation this is a significant decline in real terms.

In September 2022, we completed the Townsville Shed 1 roof replacement which is the last stage of this 10-year program. This $100 million investment in the program has extended the operating life of STL's critical Industry assets by another 40 years. We are now focused on determining capital investment priorities for the next 10 years, to ensure the reliability and longevity of the Sugar Industry supply chain.

It has been a privilege to act as the Independent Chairman of STL over the past 5 years. However, much work remains to be done. The Board continues to guide STL's strategic direction, so it is responsive to industry challenges, especially the declining sugarcane production in some regions and the need to find ways to deliver a more cost-effective service to customers without impacting the safety of people, the environment or our service offering to the Industry.

About Sugar Terminals Limited

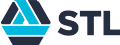

Sugar Terminals Limited (NSX:SUG) (STL) owns and operates six bulk commodity terminals in Queensland and plays a vital role in Australia's sugar market, handling over 90% of the raw sugar produced in Australia each year. STL's terminals provide 2.5 million tonnes of storage capacity and handle more than 4.6 million tonnes of commodities each year. In addition to around 4 million tonnes of bulk sugar, STL also handles more than half a million tonnes of other commodities annually, including molasses, wood pellets, gypsum and silica sands. STL has over $350 million in assets in strategic port locations across Queensland. We have in place 100 year leases with the port authorities at each of our six terminals. These leases include rolling options to extend for a further 100 year period.

Sugar Terminals Limited (NSX:SUG) (STL) owns and operates six bulk commodity terminals in Queensland and plays a vital role in Australia's sugar market, handling over 90% of the raw sugar produced in Australia each year. STL's terminals provide 2.5 million tonnes of storage capacity and handle more than 4.6 million tonnes of commodities each year. In addition to around 4 million tonnes of bulk sugar, STL also handles more than half a million tonnes of other commodities annually, including molasses, wood pellets, gypsum and silica sands. STL has over $350 million in assets in strategic port locations across Queensland. We have in place 100 year leases with the port authorities at each of our six terminals. These leases include rolling options to extend for a further 100 year period.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

Related Industry Topics:

NSX:SUG) recent activities and encourage shareholder participation at the AGM.

NSX:SUG) recent activities and encourage shareholder participation at the AGM.  Sugar Terminals Limited (NSX:SUG) (STL) owns and operates six bulk commodity terminals in Queensland and plays a vital role in Australia's sugar market, handling over 90% of the raw sugar produced in Australia each year. STL's terminals provide 2.5 million tonnes of storage capacity and handle more than 4.6 million tonnes of commodities each year. In addition to around 4 million tonnes of bulk sugar, STL also handles more than half a million tonnes of other commodities annually, including molasses, wood pellets, gypsum and silica sands. STL has over $350 million in assets in strategic port locations across Queensland. We have in place 100 year leases with the port authorities at each of our six terminals. These leases include rolling options to extend for a further 100 year period.

Sugar Terminals Limited (NSX:SUG) (STL) owns and operates six bulk commodity terminals in Queensland and plays a vital role in Australia's sugar market, handling over 90% of the raw sugar produced in Australia each year. STL's terminals provide 2.5 million tonnes of storage capacity and handle more than 4.6 million tonnes of commodities each year. In addition to around 4 million tonnes of bulk sugar, STL also handles more than half a million tonnes of other commodities annually, including molasses, wood pellets, gypsum and silica sands. STL has over $350 million in assets in strategic port locations across Queensland. We have in place 100 year leases with the port authorities at each of our six terminals. These leases include rolling options to extend for a further 100 year period.