PV12 and Dingo-5 Program Update

Brisbane, May 11, 2022 AEST (ABN Newswire) - Following recent reviews of geological data and fracture modelling analysis, Central Petroleum Limited ( ASX:CTP) (

ASX:CTP) ( C9J:FRA) (

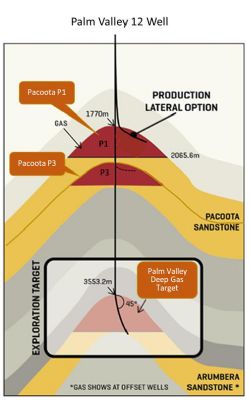

C9J:FRA) ( CNPTF:OTCMKTS) has identified the Pacoota-3 interval ("Pacoota3") as a possible new appraisal target that may be integrated into the current PV12 drilling program.

CNPTF:OTCMKTS) has identified the Pacoota-3 interval ("Pacoota3") as a possible new appraisal target that may be integrated into the current PV12 drilling program.

Gas at the Palm Valley field has predominantly been produced from the reservoir comprising the Pacoota-1 interval ("Pacoota-1") of the Pacoota Sandstone. The top of the Pacoota-3 interval is located approximately 90m below the Pacoota-1 formation.

The PV12 well is expected to intersect the Pacoota-3 formation later this month as it drills to the PV Deep exploration target, the Arumbera formation. Central and its joint venturers, New Zealand Oil & Gas Limited ("NZOG") ( ASX:NZO) and Cue Energy Resources Limited ("Cue") (

ASX:NZO) and Cue Energy Resources Limited ("Cue") ( ASX:CUE), are currently considering:

ASX:CUE), are currently considering:

1. Running additional diagnostic logs on the Pacoota-3 after drilling through the formation.

2. Purchasing certain long-lead equipment in advance of a final JV decision on appraising the Pacoota-3 interval in order to preserve the opportunity to include it in the PV12 drilling program.

3. Drilling an appraisal lateral into the Pacoota-3 interval in the event the PV Deep exploration target is unsuccessful. This would then be followed by the currently planned Pacoota-1 appraisal lateral should the Pacoota-3 lateral be unsuccessful.

Integration of the Pacoota-3 appraisal program could result in changes to the timing, sequence, duration and potential costs of the current drilling program.

A final JV decision on the Pacoota-3 appraisal would be subject to technical results obtained after drilling through the interval and the outcome of the PV Deep exploration target.

A key driver for appraising the Pacoota-3 formation as part of the PV12 drilling program is that the Pacoota-3 lateral could be quickly connected to the existing Palm Valley production facilities and sold into the currently strong gas market.

Exploration program costs

The PV12 and Dingo-5 well costs are exceeding initial forecasts. These cost increases are, in part, driven by:

- increased fuel & freight costs, which are particularly material given the remote location,

- increased cost of civil works and equipment costs, and

- delays in initial rig mobilisation to site.

The additional program costs up to 30 April total approximately $3.1 million (gross JV), without using any contingency. Central is pursuing a number of opportunities to mitigate future program cost pressures.

Central's share of costs for the PV12 and Dingo-5 wells are being carried by NZOG and Cue under an asset sale that was completed on 1 October 2021.

Message from the CEO

Leon Devaney, Managing Director and CEO of Central said, "We are seeing cost pressures throughout many aspects of the drilling program. Some of these are one-off expenses, however some cost pressures, such as higher diesel prices, are anticipated to continue, making it important to identify cost mitigation opportunities where possible. On a positive note, the Pacoota-3 formation could be a very cost-efficient opportunity to appraise an additional gas target within the PV12 drilling program, something particularly attractive given the current strong gas markets. We will continue to update the market as the exploration drilling program moves forward."

*To view the Well schematic, please visit:

https://abnnewswire.net/lnk/V6U5M2BE

About Central Petroleum Limited

Central Petroleum Limited (

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|