Okapi Acquires Maybell Uranium Project in Colorado, USA

Perth, Feb 23, 2022 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) (

ASX:OKR) ( 26O:FRA) (

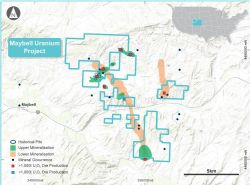

26O:FRA) ( OKPRF:OTCMKTS) is pleased to announce that it has completed the staking of 468 federal unpatented mining claims covering 3,600 ha to acquire the Maybell Uranium Project in Colorado, USA. Okapi has secured a significant portion of the Maybell mineralised trend, which includes the area of historical production and other known mineralised occurrences and prospects. Based on the historical production and exploration data there is significant potential for the further delineation and discovery of near surface uranium resources at the Maybell Uranium Project.

OKPRF:OTCMKTS) is pleased to announce that it has completed the staking of 468 federal unpatented mining claims covering 3,600 ha to acquire the Maybell Uranium Project in Colorado, USA. Okapi has secured a significant portion of the Maybell mineralised trend, which includes the area of historical production and other known mineralised occurrences and prospects. Based on the historical production and exploration data there is significant potential for the further delineation and discovery of near surface uranium resources at the Maybell Uranium Project.

Okapi's Managing Director, Mr Andrew Ferrier said:

"We are excited by the opportunity to acquire the Maybell Uranium Project in Colorado, USA. This adds another uranium asset to Okapi's North American portfolio. Completing the Maybell Uranium Project acquisition clearly exhibits the strength of the management team to identify and acquire highly prospective uranium projects in the USA.

Staking the Maybell Uranium Project is directly on strategy for Okapi who are looking to acquire assets in the right circumstances with the aim of expanding the portfolio and providing shareholders with a diversified exposure to uranium in North America. We continue to believe that the uranium space is in an upward trend and Okapi is currently assembling and developing the right portfolio of assets to create value for shareholders."

Project Location

The Maybell Uranium Project is located in Moffat County in northwestern Colorado, 5km east of the town of Maybell and 40km west of the town of Craig. The project area is situated in a rural part of Colorado, known for historical uranium mining and present-day coal and natural gas production.

Geology

The Maybell Uranium Project covers a large area that generally follows the outcrop of uranium-bearing tuffaceous sandstones of the Miocene age Browns Park Formation. Uranium is widespread in the Browns Park Formation, however, the most important ore deposits are in the upper sandstone unit which is composed of buff to grey, fine to medium grained sandstone. The sandstone unit varies in thickness from 60m to 300m and can host zones of uranium mineralisation up to, and potentially greater than, 30m thick. The underlying Wasatch formation, a host rock for uranium in Wyoming, is also present in the area and is known to contain uranium mineralisation. The physical characteristics of these permeable sandstones make them amenable for conventional heap leach processing, as well as potential candidates for ISR (In-situ Recovery) production.

Historical Production

Union Carbide operated a series of shallow open pits along a two-kilometre strike for an 11-year period between 1954 and 1964 where records show the mines produced approximately 4.3 Mlb U3O8 at an average grade of 1,300ppm U3O8. Annual production increased sharply in 1958 with the construction of an on-site processing facility and between 1958 and 1964, the Maybell area produced between 500,000 and 720,000 lbs of uranium per year.

When the price of uranium rose sharply in the mid-1970's, Union Carbide resumed mining operations in 1976 through open-pit mining and heap leaching of lower grade material. A portable ion exchange unit was installed at site and the eluate was trucked to Union Carbide's mill in Gas Hills, Wyoming. Production continued until 1981 when mining ceased due to falling uranium prices. Approximately 1.0 Mlb U3O8 was produced over this period.

Further Work

Okapi has commenced work on the compilation of historical exploration information and the acquisition of additional exploration data which we know is available. Okapi plans to undertake an integrated exploration programme at Maybell, subject to obtaining the necessary exploration permits, to confirm the historical information with the intention of producing a resource estimate for the project area.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/CW4U38PR

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|