Okapi Acquires Additional High-Grade Uranium Pounds

Perth, Oct 12, 2021 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) (

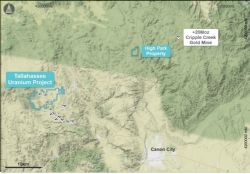

ASX:OKR) ( 26O:FRA) is pleased to report that it has acquired additional high-grade uranium pounds through the execution of a mining lease with the State of Colorado covering a highly strategic landholding that is immediately next to, and contiguous with Okapi's existing land position over the High Park Deposit located in the greater Tallahassee Uranium District (New Project Area).

26O:FRA) is pleased to report that it has acquired additional high-grade uranium pounds through the execution of a mining lease with the State of Colorado covering a highly strategic landholding that is immediately next to, and contiguous with Okapi's existing land position over the High Park Deposit located in the greater Tallahassee Uranium District (New Project Area).

Okapi Resources Executive Director David Nour commented:

"Okapi is pleased to have acquired additional strategically located high-grade pounds on very sensible terms. The upfront cost of US$62,000 represents an acquisition cost of less than US$0.025 per pound. This represents yet another highly value-accretive acquisition for Okapi shareholders."

Okapi has secured a 100% interest in the 640 acre landholding through the execution of a mining lease with the State of Colorado. The New Project Area is contiguous with Okapi's existing mining claims at the High Part Uranium deposit located 25km northeast of the Company's flagship Tallahassee Uranium Project. Okapi has the right to explore, prospect, develop and mine uranium within the New Project Area. The New Project Area was previously drilled out on 30 metre centres with approximately 550 holes drilled for 26,000m completed in the late 1970's. The New Project Area was previously held by Black Range Minerals Limited who established a JORC 2012 Resource 2.48 million pounds of U3O8 at 570ppm U3O8. Mineralisation at High Park is shallow within 5 metres of the surface with an average thickness of around 2 metres. The mineralisation is amenable to open pit mining with a trial mining program completed in 1977 where over 10kt of ore was successfully mined and processed at the former Canon City Processing Facility. Mineralisation is hosted by clay-bearing conglomerates within an extinct fluvial system or palaeochannel. Uranium mineralisation occurred post deposition of the conglomerate as oxygenated, uraniferous groundwaters moved through the host rocks with uranium deposited at redox boundaries associated with trapped organic matter within the conglomerate.

Mining Lease Terms

Okapi has entered into a 10 year mining lease with an option to extend the lease for a further 10 years as long as minerals are being produced in paying quantities. The lease covers a 640 acre parcel of land referred to as a "section" and is 1 mile x 1 mile across (1.6km x 1.6km) and owned by the State of Colorado. The financial terms of the lease include:

- One-off payment of US$42,000;

- Annual rent US$3,200;

- Annual advanced royalty payment of $16,800 deductable from future royalty payments; and

- Sliding scale gross production royalty linked to the uranium price ranging from 5% and increasing to 12%, depending on the prevailing uranium price.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/WDKD2X2L

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|