Positive Revision of JV Agreement for 64North Project Alaska

Adelaide, Feb 9, 2021 AEST (ABN Newswire) - Resolution Minerals Ltd ( ASX:RML) executed an Option, Earn-in and Joint Venture (JV) agreement on 17 October 2019 as Northern Cobalt Ltd (

ASX:RML) executed an Option, Earn-in and Joint Venture (JV) agreement on 17 October 2019 as Northern Cobalt Ltd ( ASX:N27) (former company name of Resolution Minerals Ltd) with Millrock Resources Inc (

ASX:N27) (former company name of Resolution Minerals Ltd) with Millrock Resources Inc ( CVE:MRO).

CVE:MRO).

Change Fee

As a change fee to the terms of the original agreement Resolution will issue Millrock (Vendor) 15 million Resolution Minerals Ltd shares as consideration within 20 business days under RML's existing 7.1 placement capacity.

Updated Terms of the Option, Earn-in & Joint Venture agreement to earn up to an 60% on the entire project and an 80% interest on a single "best block" include:

The new terms require Resolution to make the following spend to earn-in the 64North Project and certain milestone share and cash payments;

- Year 2 - spend a further US$0.9m and cash payment of US$100k to reach 42%;

- Year 3 - spend US$2.35m, issue 10m shares and a cash payment of US$100k to reach 51%;

- Year 4 - spend US$2.35m, issue 10m shares and cash payment of US$100k to reach 60%.

- Noting the carry forward Year 1 overspend of US$1m is taken up in the above calculations in Year 2.

Resolution can earn up to 60% of the project by sole funding exploration and making the share and cash payments set out above. Resolution may elect to form a joint venture at the completion of any stage and co-funding conditions will commence. Management is to be by committee with voting according to % interest earnt, with the party with the largest interest, holding the right to be Manager/Operator. Non-contributing parties will be diluted according to an industry standard formula (using a two times dilution rate). If any party is diluted to less than a 10% equity ownership interest their interest will revert to a 1.0% Net Smelter Return (NSR) royalty.

Right to earn up to 80% on one "Best Block"

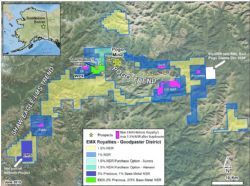

The project is subdivided into nine blocks (West Pogo, North Pogo, East Pogo, South Pogo, LMS-X, Eagle, Shaw, Divide and Last Chance) of ground as shown Figure 2.* After Resolution completes a 60% earn-in on the entire project, a joint venture will be formed over the entire project. At that point, Resolution can elect to form a specific joint venture on one block of interest, and could then earn up to 80% ownership on one block, as per the terms in the table below by loan carrying MRO to first production. Alternatively, Resolution may elect to forgo nominating a best block and co-funding conditions will commence across the entire project. Non-contributing parties will be diluted according to an industry standard formula (using a two times dilution rate).

Grace Period

During the sole funding earn-in period, Resolution has the right to trigger a single "grace period", allowing for a six-month extension to meet our required minimum expenditure for a particular earn-in stage.

Earn-in and JV Agreement Details

RML signed the binding term sheet outlining the Option, Earn-in and JV Agreement on 17 October 2019. Since reaching the agreement, RML has spent ~US$6m and will carry forward US$1m overspend to year 2 - (2nd year of Option Agreement - 31 January 2021 to 31 January 2022). The 8% Management fee due to RML as the Operator grosses up the exploration expenditure calculated to meet the earn-in requirements each year (reducing cash spend).

Claim Rents and Option payments

During the term of the agreement RML must keep the tenements (claims) in good standing including payment of annual rentals and meeting statutory exploration expenditure. The first period was 15.5 months long and bridged two annual Claim Rental payments and Option payments for a total of ~ US$455k from 17 Oct 2019 - 31 Jan 2021.

Annual Labour Commitments - Regulatory

State of Alaska claims require a minimum annual work commitment of US$420k annually across the 64North project. This was achieved comfortably in 2020 (US$6m) and overspend can be carried forward for a period of 5 years.

Regional Expenditure requirements

In years 1 and 2 there is a minimum of US$1m spend requirement on regional exploration outside of the West Pogo Block. This total was met in year 1 and forward carry of expenditure to year 2 will be taken up.

In years 3 and 4 a minimum of US$100k must be spent on each Block or the block reverts to Millrock un-encumbered.

First Right of Refusal

Resolution holds a first right of refusal to purchase Millrock's interest in the 64North Project should it wish to divest itself of the project. Millrock must offer RML 30 days to indicate RML's intention to match a bona-fide offer.

Withdrawal from Claims or Blocks

RML may elect to remove un-wanted claims or blocks from the agreement which then revert to MRO un-encumbered.

Resolution must indicate its intention to withdraw its interest by the 30 June of any year, after Year 2.

Existing Royalties, Buy Downs & Milestone Payments

A maximum 1.5% NSR, after buy downs, exists over much of the 64North Project. In early 2019 the EMX project royalty was granted by Millrock over claims not covered by historic royalties, see TSXV (EMX) announcement 24 April 2019 - EMX Royalty Corp. EMX interest is summarised on the EMX Royalty Map below. Buy downs can be triggered at RML's election costing between US$1m to US$5m resulting in a final 0% to 1.5% NSR depending on the prospect under development. On a positive decision to mine and/or filing a North American reporting code NI 43-101 resource estimate of >1m oz Au at the prospects of ER, Aurora, Reflection, Echo, Sharp, Ser, Eagle, Par, Cen and Scot, a milestone payment of $1/oz Au is due to previous prospectors. The cost of buy downs or milestone payments is considered to be insignificant compared to the development cost of a mine in this region.

Managing Director, Duncan Chessell commented:

The outcropping gold mineralisation at Sunrise Prospect and the 50-150m depth East Pogo drill targets are our focus in Alaska for 2021. Fortunately, these prospects simply don't cost as much to test as last year's deep diamond core drill targets, on which the deal was based. Working with our project partners Millrock Resources, we have re-cut the deal to reflect the more cost-effective shallower RAB drilling targets planned for 2021. The extensive data collected in 2020 sets the company up to test several highly prospective large scale gold drill targets at the 64North Project this year.

To view tables and figures, please visit:https://abnnewswire.net/lnk/3B9DH3DS

About Resolution Minerals Ltd

Resolution Minerals Ltd (ASX:RML) (OTCMKTS:RLMLF) (FRA:NC3) is a mineral exploration company engaged in the acquisition, exploration and development of precious and battery metals - such as antimony, gold, copper, and uranium.

Resolution Minerals Ltd (ASX:RML) (OTCMKTS:RLMLF) (FRA:NC3) is a mineral exploration company engaged in the acquisition, exploration and development of precious and battery metals - such as antimony, gold, copper, and uranium.

Resolution Minerals Ltd Listed on the ASX in 2017 and has a broad portfolio of assets, such as the Drake East Antimony-Gold Project in north-eastern NSW and George Project prospective for silica sand and uranium.

| ||

|