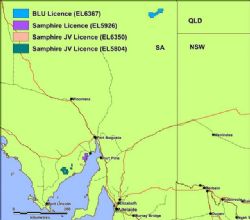

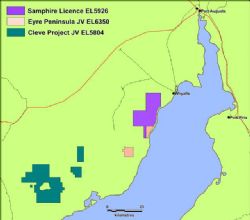

Sydney, June 11, 2020 AEST (ABN Newswire) - Alligator Energy ( ASX:AGE) and unlisted public company Samphire Uranium Ltd (Samphire) have signed a Binding Terms Sheet for the purchase by Alligator of Samphire's subsidiary, S Uranium Pty Ltd (SUPL). SUPL owns the following key uranium resource and exploration assets (Samphire Project):

ASX:AGE) and unlisted public company Samphire Uranium Ltd (Samphire) have signed a Binding Terms Sheet for the purchase by Alligator of Samphire's subsidiary, S Uranium Pty Ltd (SUPL). SUPL owns the following key uranium resource and exploration assets (Samphire Project):

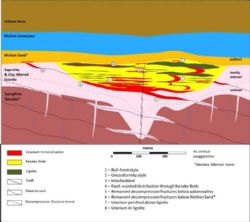

o Blackbush Inferred Mineral Resource Estimate (JORC 2012) comprising 64.5 million tonnes at a grade of 230ppm eU3O8 containing 14,850 t (32.7 mill lbs) U3O8 at a 100ppm cut-off grade;

o Plumbush Inferred Mineral Resource Estimate (stated in compliance with JORC 2004) of 21.8 million tonnes at grade of 292ppm eU3O8, containing 6,300t (13.9Mlbs) of mineralisation at a 100ppm eU3O8 cut-off grade;

o Exploration Target - Host geology and anomalism extend beyond the current known mineralisation envelope with uranium intercepts obtained in drill holes up to 3km distant. A conceptual Exploration Target of 20-30Mt of sediment hosted mineralisation at 250 to 350ppm has been estimated.

The Exploration Target and potential tonnages and grades are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

In consideration for the acquisition of SUPL, Alligator will issue 679,561,608 AGE shares to Samphire who plan to immediately in-specie distribute the AGE shares to its shareholders. Samphire has share capital of 226,520,536 ordinary shares, hence each Samphire shareholder will receive three AGE shares for every Samphire share they hold. Upon successful completion of the transaction (subject to certain conditions precedent, including regulatory and both Company's shareholders approvals) the current 1,650 Samphire shareholders will collectively hold 32% of the expanded capital structure of AGE. Alligator has used on-market valuations of similar status uranium resource projects to inform the consideration agreed to acquire the Samphire Project.

The Directors of Samphire have advised that, upon completion of the in-specie distribution, they intend to wind up the company.

The Opportunity

Alligator believes the abovementioned uranium resources provide positive value for AGE Shareholders and an opportunity to advance further work as follows:

- The grade-tonnage table for the Blackbush Inferred Mineral Resource (see Table 1*) indicates the opportunity to increase cut-off grade for a higher resource grade. For example, a cut-off grade of 300ppm eU3O8 gives a contained resource of 6,750 t (14.9 Mlbs) U3O8 at a grade of 654 ppm (similar to Boss Resources' Honeymoon Project planned restart average grade - ( ASX:BOE) release dated 21 Jan 2020).

ASX:BOE) release dated 21 Jan 2020).

- The Blackbush deposit and other mineralisation lies at a shallow depth of around 60 m in permeable sands, providing further support to its potential future extraction through either InSitu Recovery (ISR) or open pit methods depending on uranium market and price;

- Samphire (through its previous owner UraniumSA) undertook high quality laboratory testwork indicating high uranium leachability, and also undertook initial co-development work on resin extraction processes. Recent advances by ANSTO on continuous Ion Exchange (IX) and resins suitable for saline water environments indicate the likelihood of a future viable extraction flowsheet;

- The acquisition strongly augments Alligator's current and planned work on exploration for potential ISR style mineralisation on the Big Lake Uranium project in the Cooper Basin region.

- The Samphire transaction will more than double AGE's shareholder base, including investors interested and focussed on uranium projects and broadens the Company's overall exposure to uranium projects in supportive and stable jurisdictions.

Mineral Resource Estimate footnotes in Summary section:

1. See ( ASX:USA) release 27 Sept 2013 for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno.

ASX:USA) release 27 Sept 2013 for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno.

2. This information was prepared and first disclosed under the JORC Code 2004. It has not been updated since to comply with the JORC Code 2012 on the basis that the information has not materially changed since it was last reported. See ( ASX:USA) release 27 Sept 2013 and 1 Oct 2019 Samphire Annual Report for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno. Refer also to Cautionary Statement in Appendix 1*.

ASX:USA) release 27 Sept 2013 and 1 Oct 2019 Samphire Annual Report for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno. Refer also to Cautionary Statement in Appendix 1*.

Greg Hall, Alligator CEO said "We are very pleased to have concluded this Binding Terms Sheet with Samphire and we will work closely with the Samphire team to undertake all tasks to conclude the transaction."

"Alligator has used the combined experience and capacity of our team and advisors to review the Samphire Project and evaluate the potential within them for the future. The work previously undertaken on the resource, exploration targets and met testing has indicated the potential to move a possible project forward at the right time in the uranium price cycle, plus to look at expanded exploration potential in the area.

We will continue to advance our key exploration activities within the Alligator Rivers and BLU, our northern Italy nickel and cobalt opportunities, and further review additional external project opportunities within the uranium space. As the recent uranium spot price increase has shown, there is great uncertainty around the required uranium supply growth over the medium to long term, which is expected to ultimately translate through to higher prices on a sustained basis."

"Alligator Energy has one of the few Board, management and advisory teams that have discovered world class uranium projects, taken uranium projects through the public and political approval process within Australia, undertaken resource definition and into development, and managed and operated uranium mines."

Martin Janes, Non-Executive Director for Samphire Uranium stated: "The Directors of Samphire Uranium are pleased to able to present this opportunity to its shareholders. It has been nearly 4 years since Samphire Uranium was established to hold the Samphire Project as an unlisted spin off from UraniumSA and now that the sentiment in the uranium market is improving, the Directors of Samphire believe that it is timely for the Samphire Project to be combined with a portfolio of other uranium assets under a Board and management team that has serious uranium credentials."

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/8RUC0HBT

About Alligator Energy Ltd

Alligator Energy Ltd (ASX:AGE) is an Australian, ASX-listed, exploration company focused on uranium and energy related minerals, principally cobalt-nickel.

Alligator Energy Ltd (ASX:AGE) is an Australian, ASX-listed, exploration company focused on uranium and energy related minerals, principally cobalt-nickel.

Alligator's Directors have significant experience in the exploration, development and operations of both uranium and nickel projects (both laterites and sulphides).

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:AGE) and unlisted public company Samphire Uranium Ltd (Samphire) have signed a Binding Terms Sheet for the purchase by Alligator of Samphire's subsidiary, S Uranium Pty Ltd (SUPL). SUPL owns the following key uranium resource and exploration assets (Samphire Project):

ASX:AGE) and unlisted public company Samphire Uranium Ltd (Samphire) have signed a Binding Terms Sheet for the purchase by Alligator of Samphire's subsidiary, S Uranium Pty Ltd (SUPL). SUPL owns the following key uranium resource and exploration assets (Samphire Project):  ASX:BOE) release dated 21 Jan 2020).

ASX:BOE) release dated 21 Jan 2020).  ASX:USA) release 27 Sept 2013 for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno.

ASX:USA) release 27 Sept 2013 for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno.  ASX:USA) release 27 Sept 2013 and 1 Oct 2019 Samphire Annual Report for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno. Refer also to Cautionary Statement in Appendix 1*.

ASX:USA) release 27 Sept 2013 and 1 Oct 2019 Samphire Annual Report for which the Competent Persons were Mr Russell Bluck and Mr Marco Scardigno. Refer also to Cautionary Statement in Appendix 1*.  Alligator Energy Ltd (ASX:AGE) is an Australian, ASX-listed, exploration company focused on uranium and energy related minerals, principally cobalt-nickel.

Alligator Energy Ltd (ASX:AGE) is an Australian, ASX-listed, exploration company focused on uranium and energy related minerals, principally cobalt-nickel.