Mereenie Gas Reserves

Brisbane, Aug 6, 2015 AEST (ABN Newswire) - Central Petroleum Limited ( ASX:CTP) (

ASX:CTP) ( CPTLF:OTCMKTS) ("Company" or "Central") announced on 4 June 2015 that it had entered into an agreement with Santos Limited ("Santos") to acquire a 50% interest in the Mereenie Oil & Gas Field, Amadeus Basin, Northern Territory and become the operator. The gas reserves and contingent resources for the Mereenie Oil & Gas Field were last externally audited by internationally recognised petroleum resource consultants Gaffney, Cline & Associates ("GCA") as of 31 December 2012 for Santos who were at the time the 100% owner of the asset. The table in link below indicates the audited gas volumes at that time.

CPTLF:OTCMKTS) ("Company" or "Central") announced on 4 June 2015 that it had entered into an agreement with Santos Limited ("Santos") to acquire a 50% interest in the Mereenie Oil & Gas Field, Amadeus Basin, Northern Territory and become the operator. The gas reserves and contingent resources for the Mereenie Oil & Gas Field were last externally audited by internationally recognised petroleum resource consultants Gaffney, Cline & Associates ("GCA") as of 31 December 2012 for Santos who were at the time the 100% owner of the asset. The table in link below indicates the audited gas volumes at that time.

Since 2012 Santos has continued to produce and sell oil and limited quantities of gas from the field although its end 2014 gas reserves statement (which was not audited by GCA) for the Mereenie Field remains essentially unchanged from that prepared by GCA as of the end of 2012.

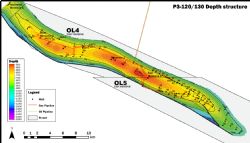

MEREENIE OIL & GAS FIELD (OL4 and OL5)

Description and history

The Mereenie Oil & Gas Field was discovered in 1963 by Mereenie 1 drilled on the crest of a large surface expressed anticline, with subsurface field area up to -25,000 acres, or 100 km2 . Below the regional Stokes Siltstone seal are hydrocarbon-saturated reservoirs of variable quality within the Stairway and Pacoota formations. In most reservoirs there is a gas cap and a gas saturated oil rim. The gross hydrocarbon column is approximately 760 metres.

Following award of production licences OL4 and OL5 in 1981, the initial focus was on oil production. By 1985, 35 wells had been drilled and the Mereenie-Alice Springs oil pipeline constructed. The pipeline was subsequently decommissioned in 2009). This first production rate peak of -3,000 bopd coincided with an oil price fall in 1986.

Gas export commenced in 1984 via pipeline to Darwin, with rates increasing to a peak of -53 TJ/d in 2005 before declining. During the seven years from 1990 a further 20 "oil" wells were drilled, adding to gas production capacity, followed by 6 dedicated gas wells during 1999-2004, and 4 oil wells since 2007. Hydraulic fracture stimulation was successfully applied during the 1990s, with only eight wells stimulated since then.

Following expiry of the long term gas contract in 2009, the operator undertook studies and then acted in 2010 with the expansion of gas re-injection to enhance oil recovery. As of 2014 the field was producing up to 1,000 bopd (oil, condensate) from 23 wells, selling - 5 TJ/d gas (1.8 PJ pa) and re-injecting the balance into the oil reservoirs. The field is able to produce and sell up to 15 TJ/d (5 PJ pa) with limited impact on oil production. Gross production of 30 years to date is approximately 17 MMbbl oil, 258 PJ sales gas, and 1 MMbbl condensate.

Hydrocarbons

Mereenie Oil & Gas Field reservoirs comprise free gas caps with associated gas saturated oil rims. The oil is light and sweet (49°API) with a cloud point of -4°C and pour point of -43 °C. Bubble point is equivalent to initial reservoir pressure (1,870 psia), initial solution gas-oil-ratio is 800 scf/bbl and the initial oil formation factor is 1.55 rb/stb. Reservoir oil viscosity is 0.35 cP. The free gas has a specific gravity of 0.72 relative to air and has a non-hydrocarbon component of approximately 10 mol% (majority N2 , minor C02 ) . The original free gas (gas cap) condensate-gas-ratio was 7 bbl/MMscf.

Geology

The reservoirs of Mereenie Oil & Gas Field are Early Ordovician sandstones of the Larapinta Group, sealed intra-formationally and beneath the regional Stokes Siltstone. Reservoirs are encountered throughout the Stairway and Pacoota formations, at depths ranging from 300m TVD (top Stairway) to 1,500m TVD (Pacoota P4). The Pacoota P1 reservoir has not been widely developed in the oil rim, however it is primarily a gas producing reservoir, and the Pacoota P3 reservoir is the primary oil producing reservoir. Oil production from the Lower Stairway and Pacoota P4 has so far been insignificant.

The sands are transitional shallow marine environment deposits with sandy channels inside silty beds, with typical Net-to-Gross ratio of 1:10. Thin pay intervals across many zones provide high likelihood that incremental reserves can be added for every new successful well. Sparse well spacing will not fully develop reserves.

Although highly variable, the average porosity of the Pacoota sandstones is 8.5% (some core $ >15%) with average permeability of 10 md (some core ka > 500md).

The Upper and Lower Stairway sandstone contains significant volumes of undeveloped gas resources in generally very low permeability reservoir sands. Current data suggests that reservoir effective porosity and permeability is limited to isolated pockets and long term production capability has not yet been tested adequately.

The Pacoota P4 first produced oil at interesting rates following the successful East Mereenie 38 well. Generally the sand is more suitable for gas production according to rock typing studies.

Development options

Near-term value creation opportunities include accelerated condensate stripping, and incremental LPG sales. Well performance demonstrates oil recovery rates of 17% to 40%, and gas recovery is estimated at 67% for developed reserves. Wells and facilities can be optimised according to market for each product.

A total of 70 wells have been drilled on the field of which 59 are currently available for production or injection. Should the North East Gas Interconnect ("NEGI") become certain and establish a market there are many additional sands which can be exploited, with the last review of these sands having occurred prior to 2000. These known gas sands are behind pipe and can be accessed and tested cheaply by workover (when compared to drilling costs); the testing of these sands to confirm their flow potential is the basis for the $10 million free-carry under the Santos transaction (see Central's ASX Announcement dated 4 June 2015). The aim is to establish 280 PJ of 2P reserves (gross 100% field level) from Mereenie Oil & Gas Field alone, which can target the Eastern Seaboard market through the NEGI or alternatively growth in the Darwin / NT gas market. The free-carry will only target the best four re-completion candidates leaving the other candidates to be addressed before the first gas through NEGI.

Encouraging gas flows have been recorded in sands that are not developed within Mereenie Oil & Gas Field. Sands of the Upper and Lower Stairway, Pacoota P2 and P4 have performed well during drill stem testing, in addition to the Pacoota P1 primary objective.

No gas production data is available for the Pacoota P2 or P4 sands, which appear largely if not wholly undeveloped. These sands flowed at attractive rates over combined zones, especially in the West Mereenie area.

Substantial developed gas reserves provide a low risk opportunity for extended domestic gas sales, particularly to eastern seaboard markets if the NEGI is constructed, thereby stimulating development.

Longer term objectives include application of technology to exploit low permeability reservoirs, thus liberating some of the vast unconventional oil and gas potential of the field.

EXISTING RESERVOIR DEPLETION PLAN

Mereenie Oil & Gas Field is a well-established mature field. The field has operated as both a gas and oil producing field which, since 2009, has had an emphasis on oil production. There is also gas being sold into the domestic market via the NT Gas Pipeline Infrastructure. Once the NEGI pipeline is available to transport gas to market the field is planned to be returned to mainly focus on gas production, while optimising oil and condensate production in the interim and later. The field will continue to be produced from existing wells (with additional wells possible), primarily by depletion drive. Once on surface, gas is compressed and dehydrated to pipeline specification without further treatment required at the present time. Eastern markets may require nitrogen removal and stripping of gas liquids.

QUALIFIED PETROLEUM RESERVES AND RESOURCE EVALUATOR REQUIREMENTS

The reserves and resources information provided by GCA in this ASX release is based on, and fairly represents, information and supporting documentation prepared by, or under the supervision of, Mr Stephen Lane. Mr Lane is an employee of Gaffney, Cline and Associates and has a BSc degree in Geology from the University of Manchester and is a member of the Society of Petroleum Engineers (SPE). The reserves and resources information in this ASX release was issued with the prior written consent of Mr Lane in the form and context in which it appears.

To view tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-CTP-729455.pdf

About Central Petroleum Limited

Central Petroleum Limited (

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|