Quarterly Activities Report and Appendix 5B - 30 June 2015

Brisbane, July 31, 2015 AEST (ABN Newswire) - Central Petroleum Limited ( ASX:CTP) (

ASX:CTP) ( CPTLF:OTCMKTS) announce the Quarterly Activities Report and Appendix 5B - 30 June 2015 with significant highlights.

CPTLF:OTCMKTS) announce the Quarterly Activities Report and Appendix 5B - 30 June 2015 with significant highlights.

- On 3rd June 2015 Central Petroleum entered into an agreement with Santos Limited toacquire a 50% interest in the Mereenie Oil and Gas Field with Central assuming Operatorshipof the field on financial closure of the transaction which is anticipated to occur on 1September 2015.

- A shortlist of four companies interested to build the North East Gas Interconnector (NEGI)was announced on 7 April 2015.

- As of 30 June 2015 the Company has 56.8PJ of certified 2P reserves at Palm Valley and Dingowith an additional 52.4PJ of 2C reserves dependent on finding a market.

MANAGING DIRECTOR'S REPORT TO SHAREHOLDERS FOR THE QUARTER

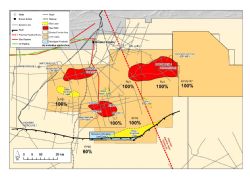

Activities this Quarter were dominated by the announcement of the acquisition of a 50% interest in the Mereenie Oil and Gas Field by Central Petroleum Ltd (Central) from Santos Limited. This field is located in the Amadeus Basin close to the Company's Palm Valley Gas Field, and gives Central a whole-of-basin position in the Amadeus. Central will assume Operatorship on closure of the transaction which is presently scheduled for 1 September 2015. This acquisition should ensure that, even without any new gas sales, Central becomes self-funding on a company wide basis with stable Australian based revenue indexed to Australian inflation. All of our gas contracts are in $A and escalated to Australian inflation whether from our 100% owned Palm Valley and Dingo gas fields or from Mereenie. The Company retains some oil price exposure through its share of oil production from Mereenie, although the transaction was negotiated on the basis of current low oil pricing.

Mereenie is a gas field with an oil rim which has been producing since 1965, and again since 2009 when the gas contract ended. Consequently most of the 70 wells were drilled and completed in oil zones, and gas contracts from 1984 to 2008 were supplied from accessing the best sands, which sufficed to meet contract. Of the five reservoir groups a subset of sands within two groups have been developed for gas, with the last bottom up review of zones on an oil production basis in 2007. Since then four wells were drilled targeting the oil zones.

When NEGI establishes a market there are many additional sands which can be exploited, with the last review of these sands having occurred prior to 2000. These known gas sands are behind pipe and can be accessed and tested cheaply by workover (when compared to drilling costs), which is the basis for the $10 million free-carry under the Santos transaction to test and certify these. Our aim is to establish 280 PJ of 2P reserves from Mereenie alone (gross Joint Venture), which can target the Eastern Seaboard market through the North East Gas Interconnect ("NEGI") or alternatively growth in the Darwin / NT gas market. The free-carry will only target the best four re-completion candidates leaving the other candidates to be addressed before the first gas through NEGI.

As a gas field, Mereenie is a low-cost conventional gas producer with marginal production costs for new gas sales of around $1/GJ. The Company has 60 TJ/day (25 PJ p.a.) field gathering and compression capacity already installed.

On 21st July 2015, we announced certified reserves for our 100% owned Palm Valley and Dingo Gas Fields of 56.8 PJ of 2P reserves and a further 52.4 PJ of 2C gas available to contract for future markets. All in all, Palm Valley and Dingo have in the order of 70 PJ of 2P equivalent Reserves available to contract into the Eastern Seaboard market.

The Mereenie transaction is designed to provide a leveraged pathway to a positive NEGI announcement. The acquisition makes financial sense for Central without NEGI but given the potential reserves from Mereenie plus approximately 70 PJ from Palm Valley and Dingo, Central expects NEGI will unlock enormous shareholder value. Given that Central now has a whole-of-basin position in the Amadeus, NEGI will substantially re-rate all of the Company's exploration acreage by providing future gas discoveries access to Eastern Seaboard markets (including the export market through Gladstone). We are confident that over half of the throughput in NEGI initially will come from conventional gas wells operated by Central. Given our low operating costs, if NEGI occurs, our operating margin should be around $3/GJ assuming a pipeline tariff to Ballera or Moomba of between $2-$3/GJ. This means that every PJ would be expected to generate in the order of $3 million EBITDA after extraction costs.

Central has met with all four pipeline proponents and is confident that the process will result in a new economic source of supply to the Eastern Seaboard market.

The low oil prices and the remoteness of the Company's Surprise Oil Field has led to the decision to temporarily shut-in oil production from this field from August 2015 to allow the Company to assess the re-charge potential of the field. Should oil prices recover significantly in $A terms, production can re-commence after assessing the pressure build-up. Last year Mereenie produced an average of 800 BOPD and from completion of the Mereenie transaction scheduled for 1 September 2015 Central will have 50% of Mereenie's oil and gas production and so Central will remain both an oil and gas producer.

Mr Whittle has chosen to step-down as Chairman of the Board at the end of this month. Andy was involved in the acquisition of the Palm Valley and Dingo assets and has been instrumental in stabilising the Company and guiding it to a new future. I will personally miss his wise and considered counsel as Chairman during difficult times and am grateful that he will remain as a Director on the Central Board giving the Company the benefit of his experience during the handover of Mereenie and the decision on NEGI. The Board has elected Rob Hubbard as its new Chairman and his corporate experience in Australia and in financing in particular will be invaluable as the company begins its growth phase following the NEGI decision expected in October.

The Company has been reviewing its policies to ensure compatibility with the latest ASX Listing Rules and a number have been changed.

The tight financial management of the Company continues unabated and has given Central the ability to expand despite adverse market conditions and without having to resort to the equity markets. Prudent efforts have been made to ensure that the Company is now built on solid foundations enabling exponential growth to occur when the conditions improve. With solid revenues under fixed price long term contracts, certified reserves and 25 PJ pa installed capacity the sowing phase has been completed and we are confident the harvesting will commence in the next 6 to 9 months.

To view the full report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-CTP-728525.pdf

About Central Petroleum Limited

Central Petroleum Limited (

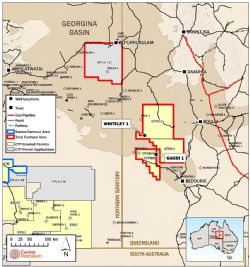

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|