Palm Valley and Dingo Await NEGI with Reserves Confirmed

Brisbane, July 21, 2015 AEST (ABN Newswire) - Central Petroleum Limited ( ASX:CTP) today announced that, as of 30 June 2015, internationally recognised petroleum consultants Netherland, Sewell & Associates, Inc. (NSAI) estimated petroleum reserves and contingent resources for the 100% owned Palm Valley Field and Dingo Field as follows:

ASX:CTP) today announced that, as of 30 June 2015, internationally recognised petroleum consultants Netherland, Sewell & Associates, Inc. (NSAI) estimated petroleum reserves and contingent resources for the 100% owned Palm Valley Field and Dingo Field as follows:

------------------------------------------------Combined Palm Valley Field & Dingo Field PJ(Central net share - 100%)------------------------------------------------1P (Proved) 28.02P (Proved + Probable) 56.82C (Contingent) 52.4------------------------------------------------

Central expects the 2C contingent resources of 52.4PJ (being contingent on markets) will be able to be converted into 2P reserves once the NT Gas Interconnect ("NEGI") becomes certain, adding to the amount of gas available to underwrite that pipeline. Palm Valley and Dingo Gas Fields are accordingly forecast to have around a combined 109.2PJ of 2P reserves when NEGI is certain.

PALM VALLEY GAS FIELD

Gas was discovered by the Palm Valley-1 well, drilled in 1965. Development of the gas field commenced after the grant of the Petroleum Lease on 9 November 1981. Gas was first delivered to Alice Springs in 1983 through the 145 kilometre Palm Valley-Alice Springs gas pipeline and subsequently to Darwin in 1987 through the 1,512 kilometre Amadeus Basin-Darwin gas pipeline.

The Palm Valley structure is an elongate WSW to ENE trending anticline defined by 2D seismic lines. The reservoirs are sandstone enhanced by natural fractures. Gas deliverability is provided by a complex interconnected network of fractures which has resulted in extremely high open hole test flow rates (137 MMcf/D from Palm Valley - 6B) and good connectivity along the crest of the field.

A total of 11 wells have been drilled on the field, of which Palm Valley 1, 2, 6, and 7 are currently producing. Gas production rates at the Palm Valley gas field have continued to decline naturally, primarily as a consequence of the reduction in reservoir pressure and the influx of formation water in the productive fractures. The rate of pressure decline has reduced in recent years due to recharge from a large volume of tight gas connected to the fracture network. Reservoir pressures also increased following shut-in after the 2012 contract ceased.

Palm Valley Field is subject to a Gas Sales and Purchase Agreement with Santos for up to 25.65PJ over 17 years (from commencement in 2012).

As at 30 June 2015, estimated Palm Valley Field net sales gas reserves and contingent resources in Petajoules (PJ) are summarised as follows:

---------------------------------------------------------------Palm Valley Field 1P 2P 2C(Central Net Share - 100%) (Proved) (Proved + (Contingent) Probable)---------------------------------------------------------------Sales Gas Reserves (PJ) 17.7 23.6 29.7---------------------------------------------------------------

Existing Reservoir Depletion Plan

Palm Valley is a well-established mature field. The field will continue to be produced from existing wells, primarily by depletion drive. Once on surface, gas is compressed and dehydrated to pipeline specification without further treatment required. The gas is sold into the domestic market via the NT Gas Pipeline Infrastructure.

DINGO GAS FIELD

The Dingo Gas Field is located in the northeast Amadeus Basin, Northern Territory, Australia, approximately 60 km south of Alice Springs.

The gas field was discovered in 1981 when the Dingo-1 exploration well tested 1.45 MMscf/d gas from the Late Proterozoic Arumbera Sandstone Unit 1. The field has been appraised by three additional wells:

- Dingo-2 was drilled in 1984 and flowed gas at a rate of 1.38 MMscf/d. A subsequent workover and hydraulic fracture stimulation improved the flow rate to 3.21 MMscf/d.

- Dingo-3 was air-drilled in 1990 and flowed gas at a rate of 2.86 MMscf/d.

- Dingo-4, drilled in 1991, encountered saline water in the reservoir and was plugged and abandoned.

The only production from the field has been during well testing operations. Total gas production during testing operations carried out from 1981 to 1991 has been estimated at 200 MMcf. This production resulted in a pressure decrease of 51 psi from an original reservoir pressure of 4,600 psi.

Limited testing was carried out prior to Central's acquisition of the field and exceeded expectations as a result the wells are expected to deliver current contract volumes.

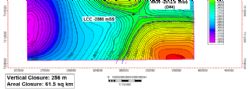

The Dingo structure is mapped as a slightly elongate west-northwest trending, simple unfaulted anticline. Areal closure to the lowest closing contour at the Arumbera Sandstone (A1 reservoir) level is approximately 61.5 km2 and the closure height on the structure is approximately 256 m. Maximum closure is defined by a narrow saddle at the south-eastern end of the structure, Figure 3 (see link below).

The primary reservoir at Dingo is the Arumbera Unit 1, which is the lowest (oldest) unit of the Late Proterozoic-Lower Cambrian Arumbera Sandstone. The Arumbera Sandstone reservoirs consist of sandstone with minor siltstone deposited in a shallow marine to delta plain environment. The sandstones are classified as mature subarkoses consisting predominantly of quartz (70%-80%) and feldspar (10%-20%), and with subordinate amounts of mica, clays and rock fragments.

Deliverability is proven with gas flows on test in Dingo-1, 2 and 3 and the field limit established by water recovery in Dingo-4. Reservoir quality is moderate and it is possible that natural fractures contribute to reservoir deliverability. In Dingo-2 in the Arumbera Sandstone Unit 1 core porosity averages 8.3% (ranging from 2% to 14.8%) and core permeability averages 1.6 mD (ranging from 0.1mD to 11.9mD).

In 2013 a Gas Supply and Purchase Agreement was negotiated with Power and Water Corporation to supply Dingo gas for up to 16PJ of gas over a 10-year supply period (from commencement in 2015) for use in the Owen Springs Power Station located at the Brewer Industrial Estate approximately 20 km south of Alice Springs. There is a possibility for the GSPA to continue with gas sales for up to a further 10 years subject to economically deliverable reserves determined by a reserves report, as further described in the Gas Supply and Purchase Agreement.

As at 30 June 2015, estimated Dingo Field net sales gas reserves and contingent resources in Petajoules (PJ) are summarised as follows:

---------------------------------------------------------------Palm Valley Field 1P 2P 2C(Central Net Share - 100%) (Proved) (Proved + (Contingent) Probable)---------------------------------------------------------------Sales Gas Reserves (PJ) 10.3 33.2 22.7---------------------------------------------------------------

To view the release, tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-CTP-726896.pdf

About Central Petroleum Limited

Central Petroleum Limited (

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|